Has the Fed put the brakes on stocks?

This morning the US Fed raised interest rates as expected, but where they caught the market napping, was in their forecast for 2017 - an additional 3 hikes, not the 2 most markets players were anticipating. However before we get too carried away, we should remember that at this time last year, the Fed were projecting four increases for 2016, but we've only witnessed the one today, hence illustrating they are far from infallible.

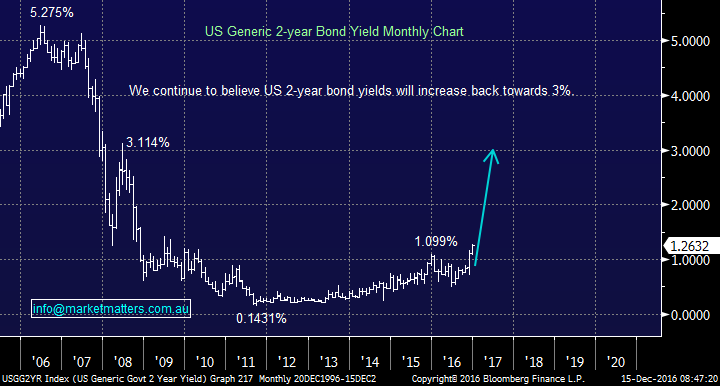

Considering our bullish outlook for global interest rates, we actually believe they are likely to be closer to the money with their forecast for 2017. The US 2-year bond rates reached their highest level since August 2009 this morning, trading around 1.27%. Our medium term target is a test of the 3% area, over double of today's rate! If this forecast comes to fruition, it's easy to envisage the significant correction for equities that we have been explaining during 2016 unfolding.

US 2-year Bond Yield Monthly Chart

This morning's relatively aggressive 118-point (0.6%) drop in the Dow is hardly surprising, considering the market has received some bad news, plus it’s had a very strong advance over recent weeks. On a fundamental basis, it's a balancing act between the positive that the Fed perceives the US economy to be strengthening and the negative that interest rates are finally increasing.

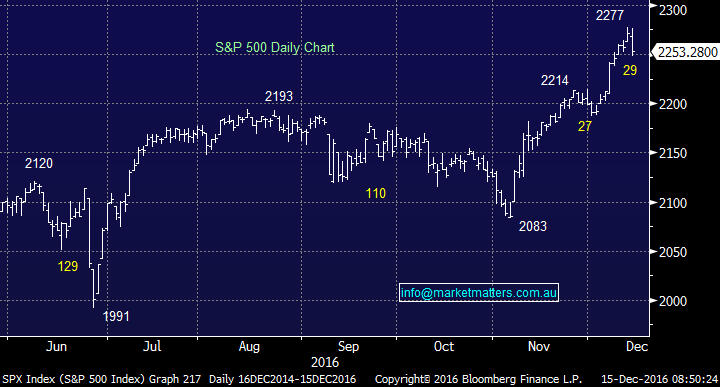

However when we stand back and look at the broader S&P500 on a daily basis, this morning's kneejerk 29-point (1.2%) fall is only equivalent to the 6-day consolidation the market experienced at the end of November / start of December. In other words, potentially a short-term buying opportunity and not time to panic overall with stocks - a break back under 2,214 for the S&P500 will turn us neutral US stocks. Our preferred scenario is US stocks consolidate into early next week, before producing a nice little Santa rally - traders could look at buying the S&P500 as it tests the 2,240's.

US S&P500 Daily Chart

While investors believe the Fed's interest rate intentions for 2017 is bad news for some sectors of the market, especially the "yield play" stocks i.e. Real Estate and Utilities, we will be evaluating our short-term plays in Westfield (WFD) and Transurban (TCL) very closely.

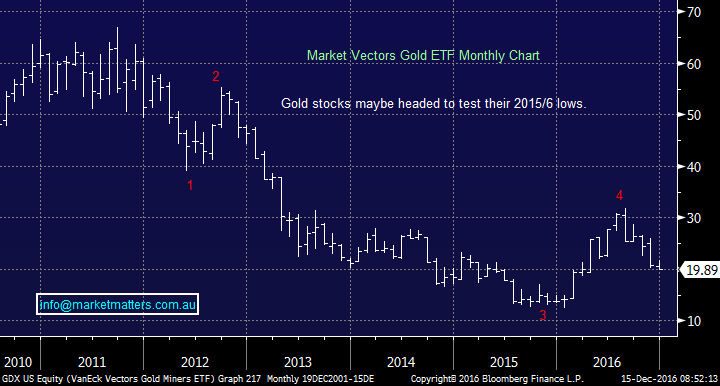

Commodities that are priced in $US also came under pressure this morning, with the $US surging over 1% on the prospect of rapidly increasing US interest rates. The one commodity in particular that we see no reason to be chasing at present is gold, which made 11-month lows this morning, even with the sector likely to fall 4-5% today.

Gold ETF Monthly Chart

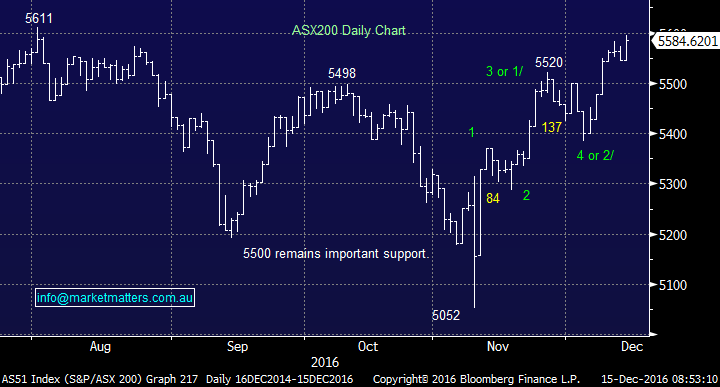

The local ASX200 traded within 16-points of its 2016 high yesterday, but now looks destined to have a reasonable pullback before attempting that milestone again - ideally with a "Santa rally" at the end of December.

The market will test 5,540 support early today, down around 40-points, but with the very poor performance by Emerging Markets last night, we would are reticent to aggressively buy this weakness. Importantly a break back under 5,500 would question our short-term bullish outlook for Australian stocks.

Not a bad time to sit back and watch for a few days, perhaps get organised for Christmas.

ASX200 Daily Chart

Summary

We remain short-term bullish stocks, but expect at least a few days consolidation as the market digests the Fed's intention to raise interest rates faster than many anticipated.

Overnight Market Matters Wrap

- All focus was on the US overnight, with the Fed raising rates for the first time in many years!

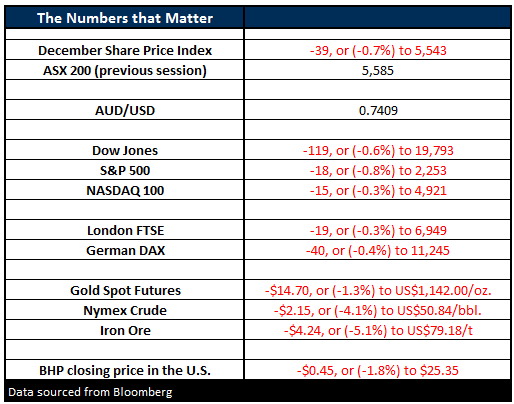

- As mentioned, investors were surprised with the Fed’s outlook for 3 rate rises in 2017, leading to a selloff in all indices. The Dow closed 119 points lower (-0.6%) at 19,793, while the broader S&P 500 closed 18 points lower (-0.8%) at 2,253.

- The volatility index didn’t move as high as some would expect, only up 3.7% and still in the complacency level.

- Iron Ore sold off 5.1% to US$79.18/t, as did Crude Oil, down 4.1% to US$50.84/bbl. BHP us expected to underperform the broader market today, after closing an equivalent of -1.8% at $25.35 from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open 39 points lower this morning, towards the 5,545 level. A volatile open is expected however, as it is December SPI Futures expiry this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here