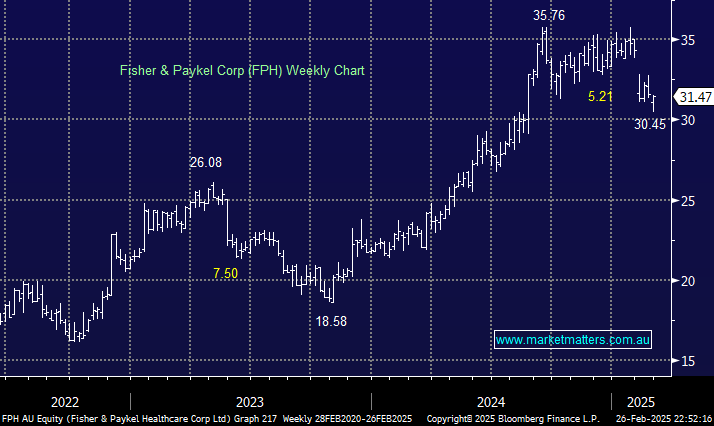

FPH is one ASX company that Trump’s tariffs have hit due to its exposure to Mexico, but with much of the risk already priced in the FPH share price following the ~15% correction, we can see surprises now on the upside. Overnight, Trump sounded committed to implementing his 25% increase in tariffs on goods imported from Mexico; this will be significant for FPH:

- FPH generates ~43% of its revenues in the United States. Of that portion of revenue, 60% of goods are supplied from Mexico manufacturing facilities.

- The business produces about 55% of global output in New Zealand (not affected by tariffs), so it has some flexibility.

- Management’s ability to optimise the supply chain and pivot their Mexico operations will be key, as simply passing on or absorbing the cost will inevitably result in a hit to earnings.

New Zealand-based FPH doesn’t report until May, which could see the stock struggle with uncertainty, but this is a business we like, and it may find itself in our Hitlist into further weakness.

- We like the risk/reward toward FPH below $30, or around 5% lower.