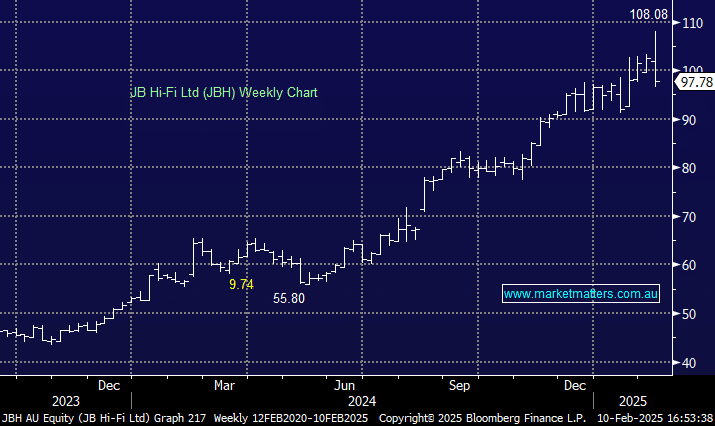

JBH –4.56%: Reported very strong 1H25 results that were a slight beat vs. consensus pushing shares higher initially. However, as is often the case when the market is looking for, and already positioned towards a good result, the share price gets hit with profit taking, which was the case today for JBH.

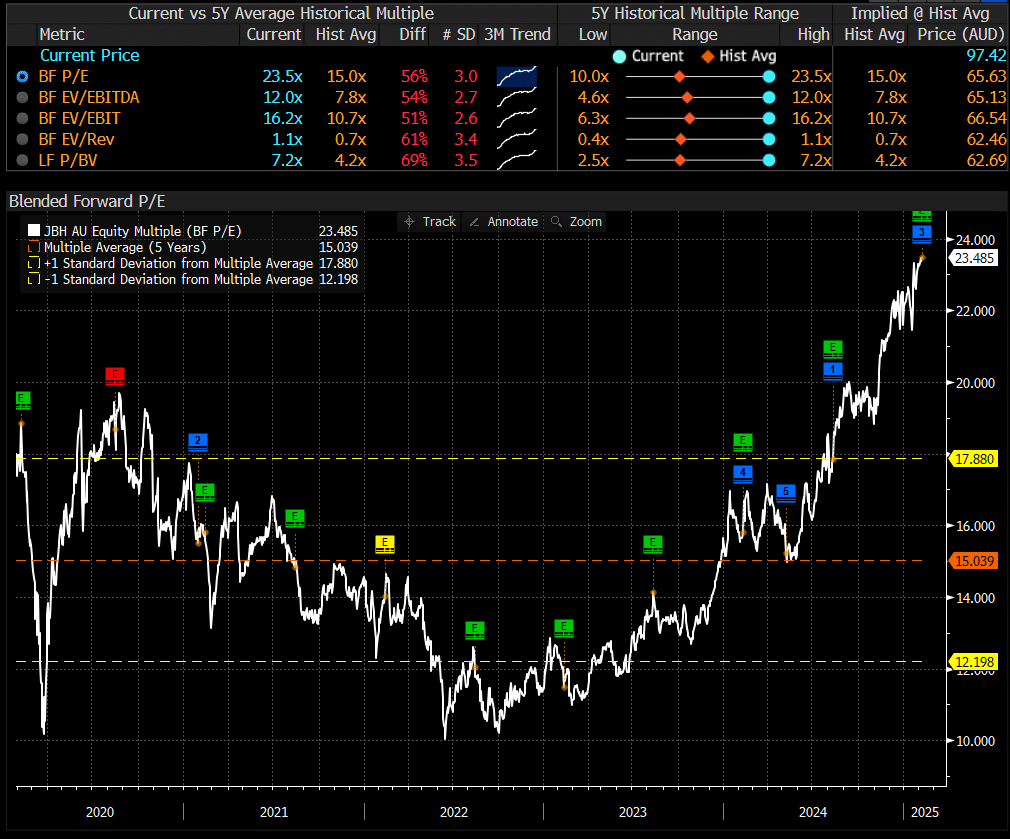

JB was trading on such as elevated multiple as shown below i.e. priced for perfection it only took a slither of doubt about the earnings outlook to set off a reversal of momentum.

A good set of numbers, but not spectacular…

- 1H25 Sales $5.67 billion, up +9.8% y/y and 2.3% ahead of consensus

- Net income $285.4 million, up +8% y/y, and 1.5% ahead of consensus

- Interim dividend per share $1.70 vs. $1.58 y/y

January sales started off well, up 7.1% on a like for life basis across the group, though management tempered the enthusiasm somewhat, saying they remain cautious given the uncertainty in the retail market and the continued competitive activity.

Key points from the conference call today, thanks to Barrenjoey as we missed it…

Trading performance. The acceleration in sales during the 2Q25 is primarily driven by volumes and also ASP mix benefit particularly during sales events. Management notes that they are cycling more challenging comparable periods during 2H25.

Category performance. The vacuums’ category was strong across JB Aus and The Good Guys (TGG), the collapse of Godfrey’s in Mar-24 has supported this growth. The coffee category was also strong. The TV category returned to growth in 2Q25 with total units up YoY driven by the strong Black Friday / Boxing Day sale periods.

Increased competitive intensity: Customers are searching for value currently so on floor discounting is elevated, especially in the computing category. Both the JB Hi-Fi and TGG brands resonate very strongly on value with consumers which has helped trading performance.

Lower AUD means price rises are coming: particularly in home appliances. with nothing yet confirmed but plenty of talk from suppliers that they will need to lift prices across 2025. TGG 2Q25 sales growth drivers: TGG 2Q25 LFL sales growth of +11.9% was driven by; 1) taking market share in home appliances in 2Q25 and 2) the TV category has rebounded back into growth.

Computing category back into growth: after a tough 2 years driven by COVID replacement cycle and new AI driven demand.

More opportunity to come in Telco: Management noted its market share in Telco is still lower than in some other categories, and it sees ongoing opportunities to grow in this category.

Retail media: still assessing the opportunity, Best Buy is focussed on sponsored adds on website, which does not fit the JB Hi-Fi model in Australia (given the focus on ‘authentic’ low prices). JBH is still assessing the best method to unlock value in retail media.

NZ expected to lose money in FY25. Although LFL sales growth has improved recently, as JB NZ laps easy comps, the market is still very weak with management flagging losses are expected in 2H25 and FY25.

……While high single digit revenue and earnings growth is enviable for any established business, the share price run has exceeded the business performance, pushing JBH up to its most expensive multiple in history, and we just don’t think it’s worth the price it’s trading.