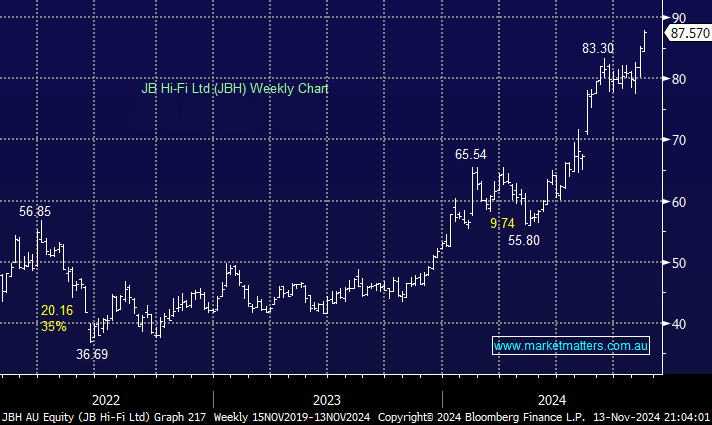

Retailer JBH has surged +67% so far in 2024, shrugging off concerns around interest rates being “higher for longer” and a tired consumer feeling worse off by the week. This is a quality operator, but we find it difficult to reconcile its current valuation. One quick metric to highlight this is the price to earnings ratio (P/E) and while not the be all and end all, the stock is trading on 20.7x, a 40% premium to its 5-year average and more expensive than it’s ever been, sitting 2 standard deviations above the norm of 14.8x!

The risk/reward is simply not compelling, although, the momentum is strong and we can’t discount higher prices in the current bullish environment. Worth noting that the stock has already collected ~$10 once in 2024 on general retail concerns, and we can see a similar retracement on the horizon.

- We remain big fans of JBH but don’t like the risk/reward of chasing it higher towards $90.