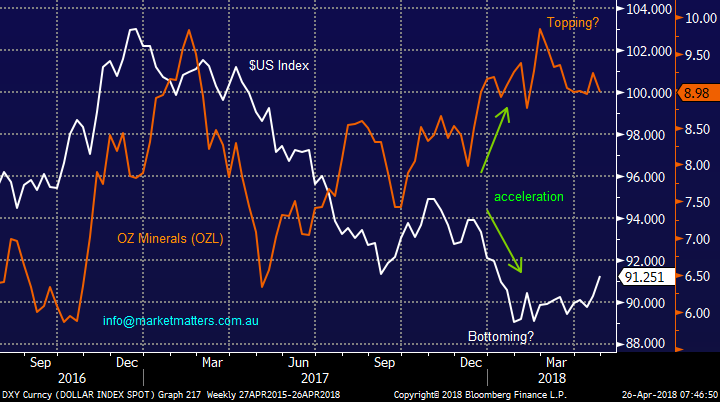

Fingers back on the market pulse! (RIO, OZL, QBE, JHG)

The ASX200 looks set to open strongly this morning, shrugging off the Dows 425-point plunge on Wednesday morning, when we were paying our respects for our ANZAC’s. With BHP looking set to open unchanged today it would appear that the banking sector is set to continue the last few days outperformance. At MM we believe the banks represent good value at current levels but obviously the Hayne royal commission remains the wild card and any further shocking news flow may challenge the recent flickers of optimism.

Our view at MM of the local ASX200 remains unchanged – the close above 5900 has rekindled our mildly bullish short-term outlook – ideally we will see a test of the 6200 area in 2018 for an excellent selling opportunity.

The last few days have thrown up some significant eye catching moves that could easily be missed hence following our day on the sidelines we are going to look at 5 points in today’s market we believe are extremely important moving forward. Some of these points do overlap but we’ve attempted to separate them with consideration to investing within Australian equities.

ASX200 Chart

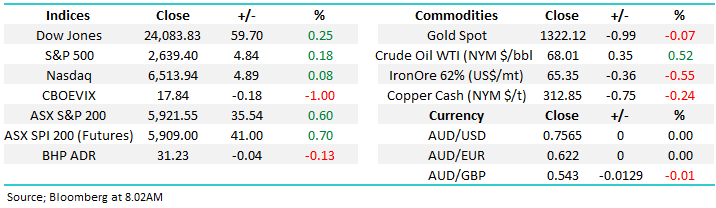

1 The $US continues to gain strength in a quiet but significant manner

This morning the $US has surged to its highest level in 2018 with our initial target remaining ~4.5% higher. The catalyst for this bout of strength appears to be interest rates / bond yields with US 10-year bond yields closing above the psychological 3% overnight, their highest level since early 2014. We’ve been calling the 3% level for months but the current momentum, especially in the shorter-dated 2-year bonds, suggests markets may be underestimating how far / quickly these bond yields can rise following the end of the multi-decade bear market in interest rates.

- We remain both long and bullish the $US – we recently bought the Beta Shares ETF, USD.AXW.

We continue to feel that the $US is like a volcano bubbling away which may be about to explode higher, subsequently altering the short-term investment landscape in a dramatic fashion – earlier this month Bloomberg wrote an article discussing a $745bn bet in the bond market against the $US strongly implying there was plenty of room for a significant squeeze higher in the greenback.

$US Index Chart

US 10-year bond yields Chart

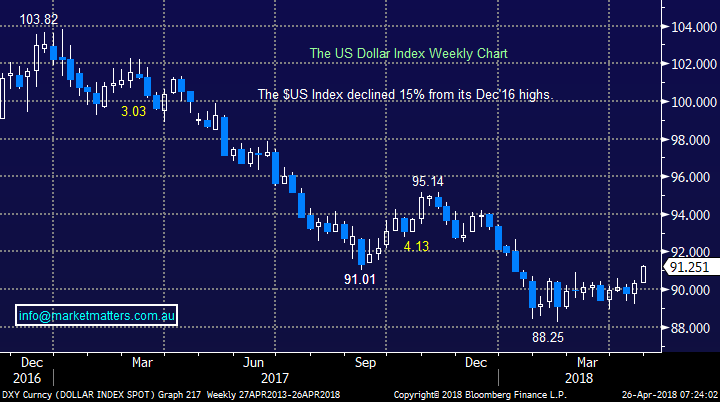

2 MM is getting off the resources bandwagon

At MM we went aggressively long the resources sector when markets plunged in February, following a plan that had been laid out for a number of weeks. The important logic was 2-fold:

- The aggressive pullback in equities was just a warning of what was on the horizon and not the end of the post GFC bull market.

- We believed the $US would continue its over 2-year, 15% depreciation, before forming a major low – theoretically short-term bullish for commodities and their related stocks.

The inverse correlation between the $US and the underlying commodities is very strong and one of the reasons we have been following our plan to sell our resources positions into current strength e.g. The overnight small +0.5% rally in the $US led to another fall of $US8.50/oz in gold and $US1.2/lb in copper, an expected reaction considering both are denominated in the strengthening $US.

- The correlation between the $US and base metal prices has been excellent since late 2016 i.e. $US lower has led to higher base metal prices – see chart below.

Hence now we believe that the $US has bottomed the reason to be long resources has gone.

$US Index v Bloomberg Base Metals Index Chart

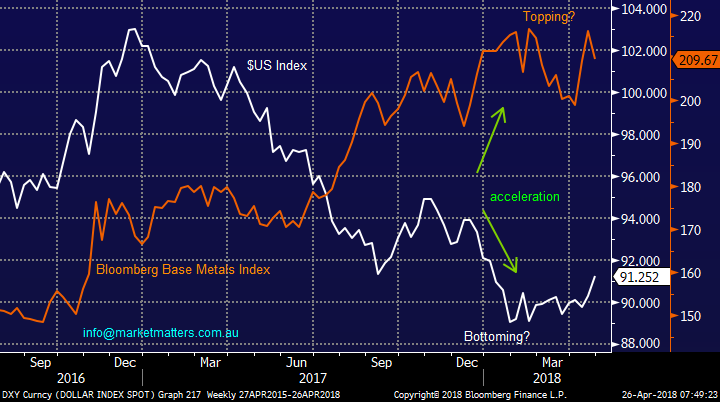

However, because Australian companies derive their final profits in $A the rise in the $US should theoretically cushion them hence below we looked at the correlation between both RIO and OZ Minerals and the $US to see if investors should be concerned by a rising $US. The answer is clearly a “yes” in both cases a rally of ~5% (our target) by the $US implies a drop of ~10% in the respective stocks.

- On a risk / reward basis MM has no interest in buying / owning most resource stocks at least in the short-term.

Importantly however we do like the like the sector medium-term as we believe inflation will continue to pick up implying resources have not finished their 2 1/2 -year advance.

$US Index v RIO Tinto (RIO) Chart

$US Index v OZ Minerals (OZL) Chart

3 $US earners should continue to shine

Overnight the “little Aussie” battler fell to its lowest level this year and if we are correct there’s another 10-15% further to go. The message is simple stocks with $US earnings should outperform the market. For example:

- AAD, AMC, ANN, BLD, BXB, COH, CPU, CSL, IPL, JHX, JHG LLC, NWS, ORA, QBE, RMD, SHL, TWE and WOR – we own JHG and QBE.

These companies have already outperformed the broader market since mid-2016 which is interesting as the $A appreciated over this time, clearly fund managers did not believe the rally in the $A was enough to outweigh the strengthening of the US economy when compared to our own.

Hence due to this outperformance there will likely be a classic “buy on rumour sell on fact” down the track, our best guess at this stage will be when the $A cracks below the psychological 70c barrier.

Australian Dollar ($A) Chart

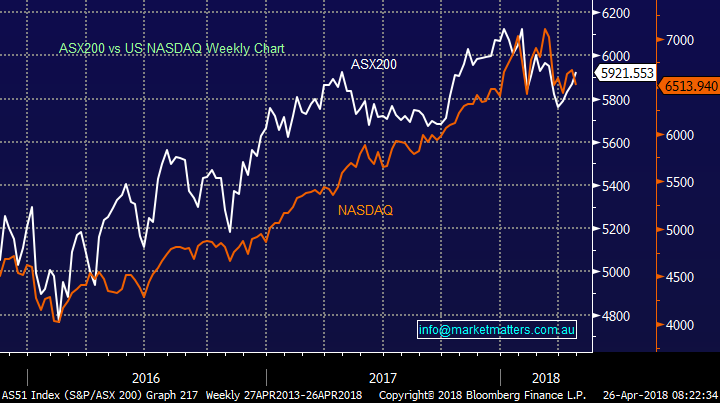

4 US stocks look set to underperform Australia

We have touched on this opinion earlier in the week but felt today was an optimum time to reinforce the view.

- MM believes the ASX200 will outperform the US tech based NASDAQ over the medium-term - potentially this may mean by falling less when the post GFC bull market does experience a meaningful correction.

NB This view does not take into account any currency fluctuations and if we are correct and the $A is set to fall 10-15% and material underperformance by the US market will be cushioned for local investors.

ASX200 v NASDAQ Chart

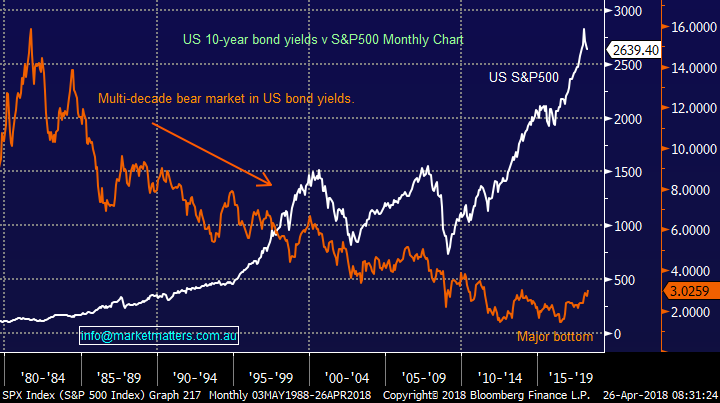

5 Higher bond yields are likely to increase volatility & sector rotation

At MM we’ve been large believers that the multi-decade bear market in interest rates is over and with US bond yields more than doubling since mid-2016 this view is feeling smack on the money.

Many investors are understandably becoming concerned by rising interest rates, even though the RBA has not yet joined in the global “interest rate rising” party.

- With US government backed bonds yielding more than their stocks there is clearly an alternative to the previously large beneficiary of “cheap money” i.e. shares.

Longer-term we remain bearish stocks looking for a ~20% pullback which we’ve already seen twice since Sydney held the Olympics. However, with US fund managers already holding multi-month high levels of cash pessimism may be a touch too high for this correction to start just yet.

- MM intends to continue increasing its cash position / negative stock market facing positions in 2018.

US S&P500 v 10-year bond yields Chart

Conclusion

1 We remain both bullish and long the $US – we are long via the Beta Shares ETF USD.AXW.

2 We believe that the Australian resource stocks have a significant risk of a ~10% correction.

3 We believe that local stocks with $US earnings should continue to outperform until the $A is at least below the psychological 70c area.

4 We believe that the local market will finally outperform the US before FX considerations.

5 MM still believes a greater than 20% correction for stocks is looming on the horizon but fresh highs in 2018 would not surprise first.

Watch for alerts.

Overnight Market Matters Wrap

· Overnight markets recovered from early weakness, with the Dow recovering to close 0.25% stronger. After market, Facebook has rallied 5% after smashing revenue expectations, with quarterly revenue of us$11.97bn and 1.45bn daily users.

· On Tuesday night the Dow and the tech heavy Nasdaq each slumped 1.7% and the broader S&P 500 fell 1.3% as the technology sector was weighed down by further weakness in Google parent Alphabet, while industrial giant Caterpillar sold off following a weaker than expected earnings outlook statement. Overall, however, US quarterly earnings season to date has been ahead of expectations with a survey showing 79% of companies have beat consensus numbers.

· The US$ remains strong, with the A$ rate at US75.6c. Commodities were mixed overnight with iron ore around 1.4% weaker at $66.4/tonne and the gold price also lower t us$1320/oz. Both BHP and RIO are slightly weaker in overnight trading.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, towards the 5930 area this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here