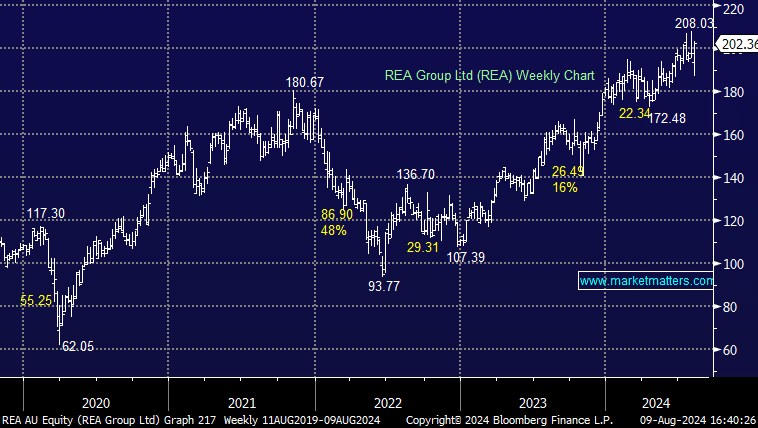

REA +6.78%: Solid FY24 result today from Australia’s premier real-estate site, with their core business performing well, supported by good growth in Financial Services, while their Indian business grew revenue 31% y/y, a better outcome than expected.

- Revenue of $1.45bn a slight beat

- Core Net Profit After Tax (NPAT) of $461 million, up +24% yoy, and just ahead of the $457 million consensus

- Final dividend of $1.02 pretty much inline.

While they continued to assert their dominance over Domain (DHG) in the 4Q, they also had slightly higher costs with opex up +18% y/y. That said, the outlook is good, they talked to a healthy property market, with strong demand across the country driven by high levels of employment and immigration. Supply is also robust, with sellers confident in the level of demand and properties selling quickly with days on site well below the 6-year average.