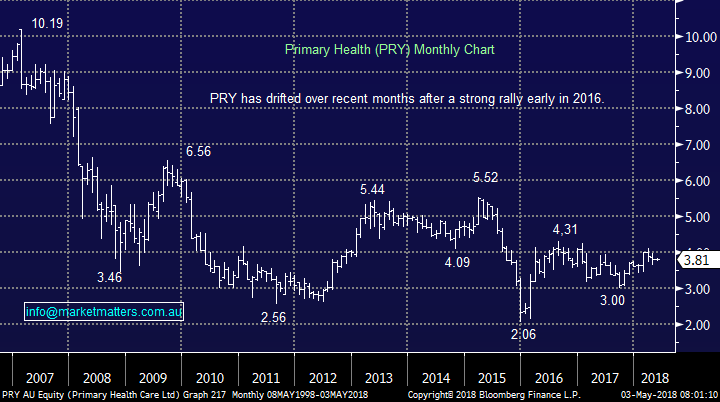

3 Takeover Targets outside Mining Catching Our Eye (BXB, AAD, PRY)

Yesterday the ASX200 rallied impressively for the 4th consecutive day, gaining another 35-points / 0.58%. Amazingly following the impulse 5-week / +5.7% rally, we are now only sitting just 3.3% below its 10-year high and at MM our view is it’s simply a matter of time before this level is breached – the doomsday merchants of February / March have gone very quiet.

- The ASX200 may be due a 1% pullback, or a few day’s consolidation, but investors / traders should recognise the markets rallying to a fresh level of equilibrium, hence any surprises are likely to be on the upside.

This morning looks set to be another great example of how markets react when they have the “bit between their teeth”, the Dow has fallen 174-points this morning but the ASX200 futures are still pointing to a higher opening locally. The dynamic feels simple, fund managers have been too bearish for too long and they now find themselves scrambling to increase their equity exposure into a rising market. The market corporate news yesterday was neutral at best with JB-Hi-Fi (JBH) and InvoCare (IVC) getting smacked while QANTAS (QAN) and Mineral Resources (MIN) rallied strongly but the market just kept rolling higher as investors searched for stocks to buy.

- Market Matters remains bullish the ASX200, initially targeting the 6250 area, or ~3.3% higher.

NB Assuming we have already seen the low for May at 5978 the short-term upside targets will surprise many e.g. even if May has the equal smallest range for the last 6-months we should still test the 10-year high i.e. 6150.

Today’s report is going to look at 3 potential takeover targets in the Australian market but outside of the mining sector.

ASX200 Chart

A quick update of 2 big movers yesterday

InvoCare (IVC) tumbled -7.2% following another downgrade to its full year numbers while the company attempted to talk up future innovation / developments.

- We remain bearish IVC targeting ~$10, another 15% lower.

InvoCare (IVC) Chart

Conversely QANTAS had a great day, rallying 8.1% following the release of its third-quarter update showing its on track to deliver a record pre-tax profit.

- At MM we are bullish QAN short-term targeting ~$7.

Two simple examples of “the trend” is your friend, albeit in opposite directions for these cases.

QANTAS (QAN) Chart

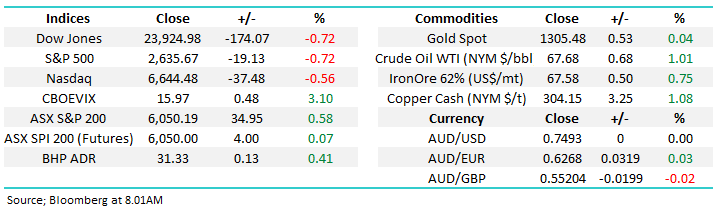

Overseas Indices

The broad based US S&P500 slipped 0.72% overnight following the Feds decision to leave interest rates unchanged plus accompanying rhetoric which led some pundits to question whether they would let inflation climb, historically a very dangerous balancing act.

- We continue to believe the ASX200 will outperform US stocks e.g. over the last 5-weeks the local market is up 5% while the S&P500 is marginally lower.

US S&P500 Chart

However European markets had another stellar night as funds appear to be crossing the Atlantic with the German DAX leading the way rallying +1.5%. Importantly it should be remembered that the Australian market is far more correlated to Europe than the US which clearly fits what we’ve been experiencing over recent weeks.

- We remain bullish the DAX targeting ~14,000, around 9% higher – a very encouraging indicator for the ASX200.

German DAX Chart

Non-mining potential takeover targets

As we discussed in the Weekend Report, the music is still playing in the M&A space assisted by low interest rates and driven by falling supply of fresh stocks into growing demand.

However picking the next takeover is most certainly not like shooting fish in a barrel it has a large margin of luck, however, if holding a few stocks that “may” get taken over but you like anyway does make sound investment sense.

1 Ardent Leisure (AAD) $1.94

AAD has had a tough time since the Dreamworld disaster but its main event business is firing nicely. We think the business is reasonably well positioned moving forward and could easily rally back towards $2.75 in the current environment where fund managers are chasing “cheap / value” stocks.

Add to the mix both the Sun Hung Kai Opportunities fund and listed car park owner Ariadne becoming substantial shareholders and you may have a stock in play.

- We like AAD as a short-term play but would run stops below $1.85 i.e. 5% risk.

Ardent Leisure (AAD) Chart

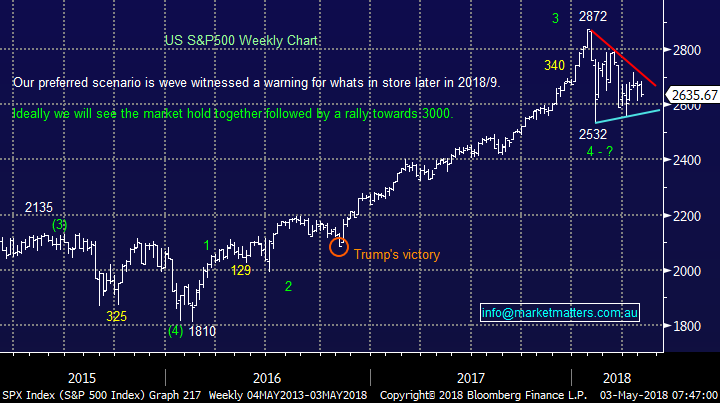

2 Primary Healthcare (PRY) $3.81

PRY has been rumoured to being stalked by China’s Jhango Group who have a holding of just over 10%. This could be the now, or never, time for the Chinese who’ve been touted as a potential suitor since 2016.

The stock currently yields 1.7% and is trading on a Est 2018 valuation of 14.5x so it’s relatively cheap.

- We like PRY technically targeting over $5 with stops below $3.45 – good 3-1 risk / reward.

Primary Healthcare (PRY) Chart

3 Brambles (BXB) $9.87

International logistics group BXB is down almost 20% since mid-2016 potentially bringing the stock up on suitors’ radar as opportunistic “value investors” may like what they see short-term.

The stock currently yields 2.9% fully franked and is trading on an estimate 2018 valuation of 17.9x, so it’s not in the unloved bargain basket.

- We like BXB at current levels targeting $10.75 with stops under $9.55 i.e. solid 3-1 risk / reward.

Brambles (BXB) Chart

Conclusion

We like AAD, PRY and BXB as potential takeover targets and stand alone investments at todays prices.

Watch for alerts.

Overnight Market Matters Wrap

· US markets fell in the last hour to close just off the lows following the US interest rate announcement. Meanwhile, reporting season continues, with Apple closing 4% higher after reporting after the close yesterday and announcing a large share buy-back.

· The US Fed voted unanimously to keep interest rates on hold as expected, and the policy statement was largely unchanged but did note that inflation has moved closer to their target. The odds of a hike in June remain unchanged at around 95%.

· BHP is expected to outperform the broader market after ending its US session up 0.41% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 23 points higher, testing the 6075 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here