Our 5 favourite resource stocks if sector weakness continues. (BHP, IGO, FMG, AWC, OZL)

The ASX200 continued its 10-day retreat yesterday, falling another -0.5% led by heavyweight energy stocks Woodside Petroleum (WPL) and BHP Billiton (BHP), who both declined by ~3%. Conversely the real estate sector was the standout winner rallying another +1.6%, making it an almost +5% bounce in 5-days.

The markets remain extremely skittish on the stock level as both the EOFY and May seasonal factors are weighing on investors’ minds. During our trading session the Dow futures were up around 100-points but we basically ignored the positive comments around Korea and gradually slipped lower – a smart move in our opinion as the Korea-US soap opera just feels like market noise that helps journalists fill space in newspapers.

At MM we remain short-term bearish the oil & resources space hence for the ASX200 to hold onto the psychological 6000-area the banks / financials must finally put the royal commission behind them, but alas there are no signs of this evolving so far.

Overnight US stock markets were closed due to Memorial Day and Europe was fairly quiet, the main talking point was a another 2% fall in crude oil futures, making it a -9.7% pullback in just 5-days – as we said In the Weekends Report MM believes the comments from Saudi / OPEC suggesting supply would increase in the second half of this year is meaningful and bearish crude.

- Medium term MM remains mildly bullish the ASX200 targeting 6250 but the risk / reward is no longer compelling for the buyers. – we remain in overall “sell mode”.

Today’s report is going to look at 5 resource stocks that MM likes at lower levels if their current decline continues.

ASX200 Chart

5 resource stocks we like into weakness

At MM we turned bearish resources a few weeks ago and it now appears the “chickens are finally coming home to roost” with the likes of BHP falling -7.3% over the last 3-weeks.

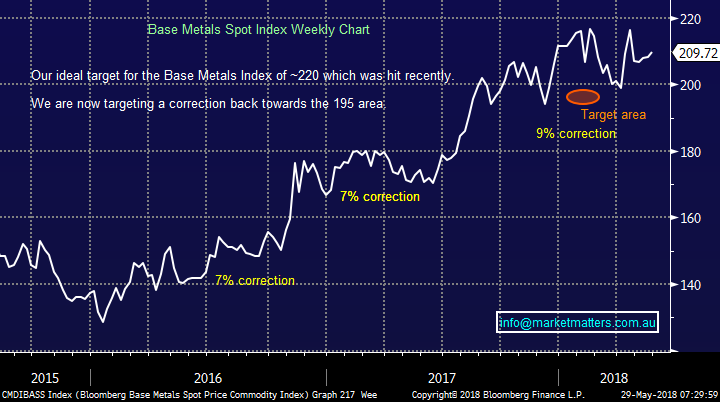

- Short / Medium-term we remain bearish the Bloomberg Base Metals index targeting a further ~7% decline.

NB The Bloomberg Base Metals Index is comprised of non-precious metals including Aluminium, Copper, Nickel and Lead.

Bloomberg Base Metals Index Chart

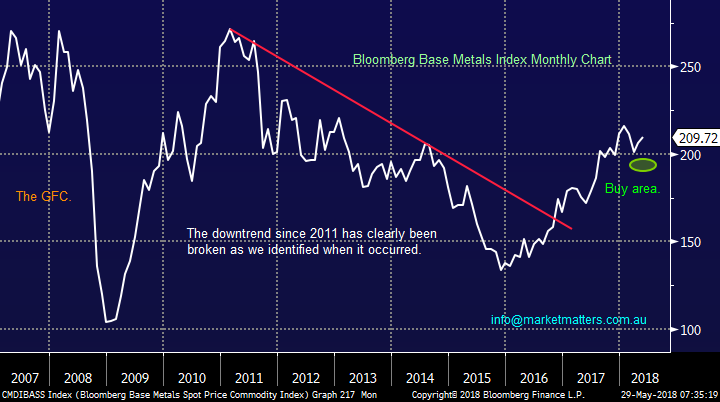

However, in the bigger picture MM remains bullish both interest rates and inflation, excellent ingredients for resource stocks to rally. The long-term downtrend in base metal prices since 2010 has clearly been broken and we are keen buyers of any significant weakness – we should always remember that resource stocks and their underlying commodities are historically volatile beasts which creates opportunities for the relatively nimble.

- Longer-term we remain bullish the Bloomberg Base Metals index targeting the sub 200 area to rebuild our resources exposure.

Bloomberg Base Metals Index Chart

On the macro level we believe bond yields, especially in the US, have got slightly ahead of themselves and a period of consolidation is commencing. Hence the below logical sector rotation has been unfolding in recent times.

- Over the last 5-days resources / energy stocks have fallen while the “yield play” real estate / utilities have bounced solidly e.g. OZ Minerals (OZL) -8.1% while Vicinity Centres (VCX) is +6.5%.

We believe this a countertrend rally which looks to have further to unfold but it’s a move that should be faded not embraced as when the uptrend in yields gets back on track its likely to snap back very quickly.

US 10-year bond yields Chart

The following 5 resource stocks are heading up our buy list if the current sector falls continue.

A huge part of successful investing is being prepared because if we are correct the resources stocks will probably look pretty awful just when we should / want to buy them hence a laid out plan makes it a lot easier to press the “buy button”.

We should also not forget that 70% of the resources sector has net cash with only the big end of town sitting on net debt. This makes the space ripe for M&A and we’ve mentioned a few potential scenarios within the 5 stocks below.

However also remember we are cautious stocks into 2018 / 9, hence we are highly likely to be fussy with any purchases being comfortable to “miss out” if the stocks do not correct enough.

1 BHP Billiton (BHP) $32.11

No surprises following our recent reports that BHP is our number one pick with capital returns coming soon and they are likely to be huge.

The stocks fairly volatile and even while its doubled in the last 2-years it’s still managed retracements of 18.7%, 21.1% and 12.5% - a ~16% correction from the 2018 high which is well within these degrees of recent corrections.

- MM is looking to buy BHP ~$29, or 9% below yesterdays close.

BHP Billiton (BHP) Chart

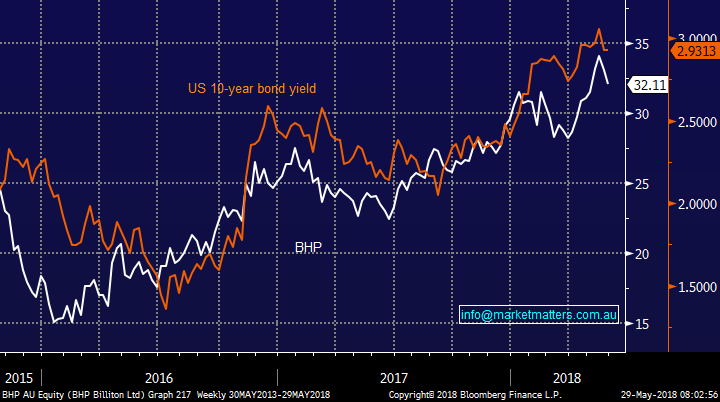

Another interesting correlation I touched on the other day is that between BHP and US 10-year bond yields, it suggests that if we are correct and US bond yields consolidate / correct then BHP is likely to continue with its recent pullback.

BHP Billiton (BHP) v US 10-year bond yields Chart

2 Fortescue Metals (FMG) $4.50

Fortescue actually has infrastructure in place for 100-years compared to BHP / RIO with about 50-years in the iron ore space and FMG’s is the best!

FMG is slowly emerging form a pricing discount which has led to a poor relative valuation. While the discount is closing extremely slowly debt is still being trimmed and a positive future is well mapped out.

We like FMG into weakness and the current 9% drop in ore futures is translating into an expected fall in FMG. It “feels” like a spike down to fresh 2018 lows in the bulk commodity, another ~5%, is a strong possibility and this should provide excellent entry into FMG.

- MM is in stalking mode with FMG currently looking to buy ~$4 for both Platinum and Income Portfolios.

Fortescue Metals (FMG) Chart

Fortescue Metals (FMG) v iron ore Chart

3 Alumina (AWC) $2.57

AWC has been trading higher with a huge tailwind from the almost out of control alumina price. The alumina price is looking set to settle well above recent years average levels, although well below the crazy levels of mid-April i.e. aluminium has corrected ~17% while AWC has pulled back 15% illustrating perfectly the strong correlation between the two.

Also, AWC has a new share holder agreement with Alcoa leaving the door open for Alcoa, or a Chinese player, to have a tilt at AWC.

- MM likes AWC for both of our portfolios around $2.40, another 6% lower.

Alumina (AWC) Chart

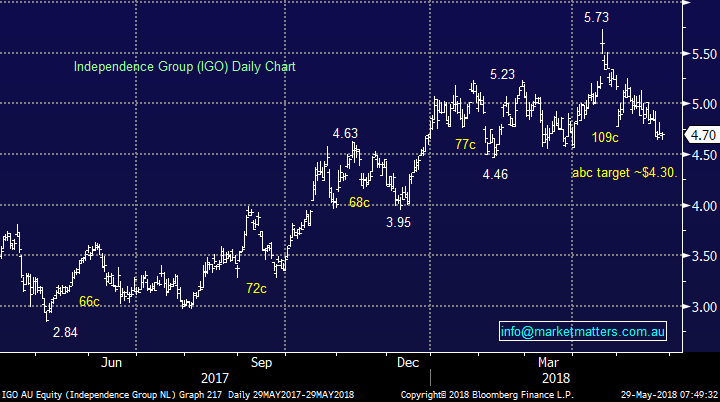

4 Independence Group (IGO) $4.70

Nickel producer IGO is set to benefit from Brazilian giant Vale cutting its production for the next 5-years by 15%, even though they are going to “preserve optionality” due to electric vehicle battery demand.

IGO is also a potential takeover target for large global miners keen to access its Nova nickel operation plus a pretty good gold asset in Tropicana which could be on sold.

- MM intends to average its position in IGO if the opportunity arises around $4.40, or 6% lower.

Independence Group (IGO) Chart

5 OZ Minerals (OZL) $9.73

OZL was undoubtedly one of resources plays that we took profit on way too early however in true OZL manner its now correcting pretty fast – already over 9%.

This gold and copper producer is certainly at the big end of town for a takeover bid but in today’s environment it should not be ruled out.

- MM likes OZL back below $9, where it was languishing for most of mid-April.

OZ Minerals (OZL) Chart

Conclusion

We like the below 5 resources stocks at the levels shown:

1. BHP Billiton (BHP) around $29.

2. Fortescue Metals (FMG) around $4.

3. Alumina (AWC) around $2.40.

4. Independence Group (IGO) around $4.40.

5. OZ Minerals (OZL) below $9.

Watch for alerts.

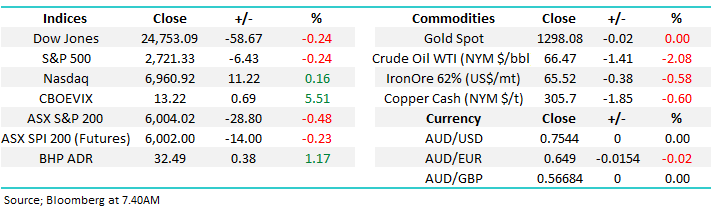

Overseas Indices

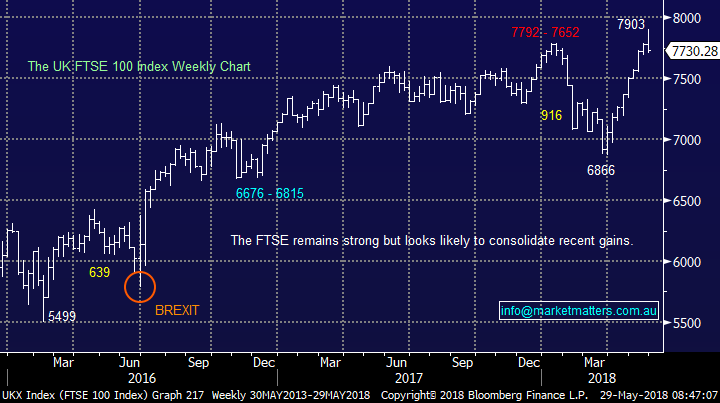

No change, we remain mildly bullish overseas indices targeting fresh 2018 highs for many but we are mindful that we are in May plus the UK FTSE has already reached MM’s new all-time high target.

UK FTSE Chart

Overnight Market Matters Wrap

· The US & UK markets were both closed overnight for holidays. The lead from European markets is slightly weak.

· The energy sector continues to have a negative contribution to the overall market, as oil slides further to the downside, towards US$66.47/bbl at present.

· BHP is expected to claw back some of its losses overnight after ending its US session up an equivalent of 1.17% from Australia’s previous close towards $32.49.

· The June SPI Futures is indicating the ASX 200 to open marginally lower and try and hold the 6000 handle.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/05/2018. 7.46AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here