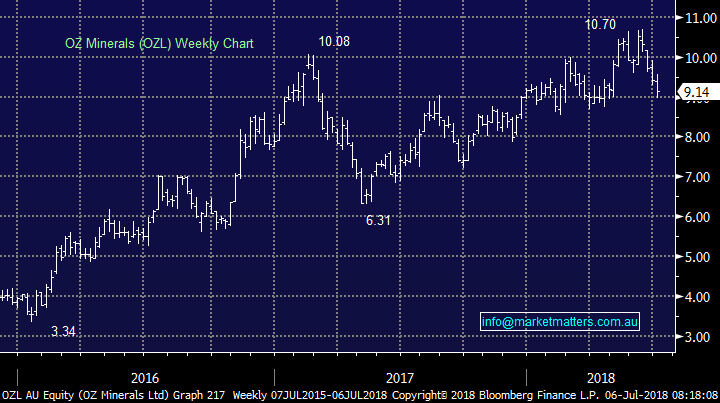

Keeping our finger on the pulse as markets stare down trade tensions (OZL, BAL, DMP, WEB)

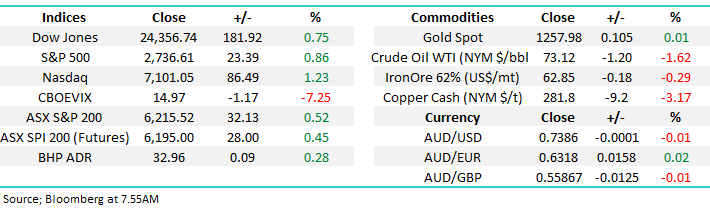

US stocks came back online last night following their 4th of July Holiday on Wednesday and while volumes were around 20% below average, the tone was a bullish one with technology shares once again leading the way. Trade tensions were simmering in the background which caused some volatility however given the US will apply tariffs on $34 billion worth of Chinese goods at 2pm this afternoon our time, i.e. in a few hours, the positive moves show that US investors are taking it in their stride. Clearly the move takes the trade tussle between the two global heavyweights to a new level, and if we use the recent stock market performance of the respective countries as a guide, the perception clearly is that China has more to lose from all of this than the U.S do.

US S&P 500 Chart

Shanghai Composite Chart

Overnight both the Governor of the Bank of England (BoE) and the US Federal Reserve suggested that the threat of trade wars was beginning to have an impact on growth – and it is. In terms of growth we look at global PMI data and the trends here peaked late last year. While the actual volume of US-China trade affected by the moves is reasonably low - about 4% of total trade, and there will be an offset globally given China and the US will look to source / sell product elsewhere, todays move to pull the trigger is a big one.

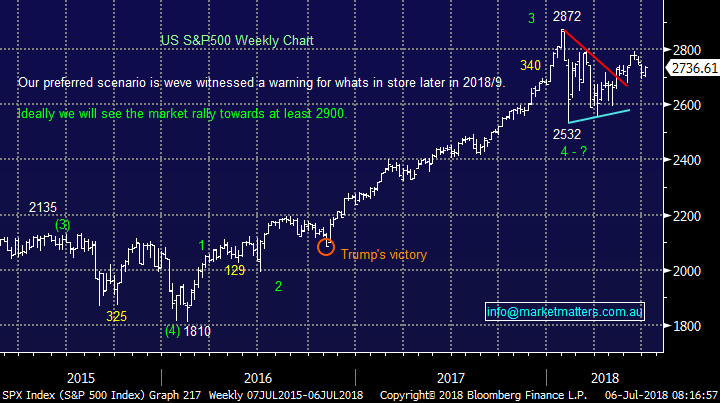

Commodity markets have been interesting, but overall weak supporting the view of both central banks. The recent weakness across the global commodity complex is a sign that traders are reducing growth related bets. We think this is a buying opportunity in the sector with the base metals index trading to our downside target overnight.

Global mining companies are flush with cash and capital management such as share buybacks will likely happen into any major weakness, therefore supporting prices. Overnight, Glencore launched a massive share buy-back commencing immediately, buying up to a $1 billion of their own stock. BHP could do something similar.

Base Metals Spot Index Chart

Yesterday the Australian market was strong overall, with the banking sector providing most of the support offsetting some continued weakness amongst the miners, a theme we’ve been positioned for although we were a bit early to the dance! CBA for instance has now traded up from a low of $67.22 to close yesterday above the $74.00 resistance level. Banks remains a core part of the MM Growth Portfolio for now given we expect strong relative performance from the sector into any market weakness. Commodities have been weak however our exposure here is low (but we are looking to add) while any escalation of trade tensions should help to support the $US and therefore overseas earners – stocks like CSL, Cochlear, Macquarie (MQG) & Treasury Wines (TWE).

ASX 200 Chart

Stocks on our radar as markets hold up

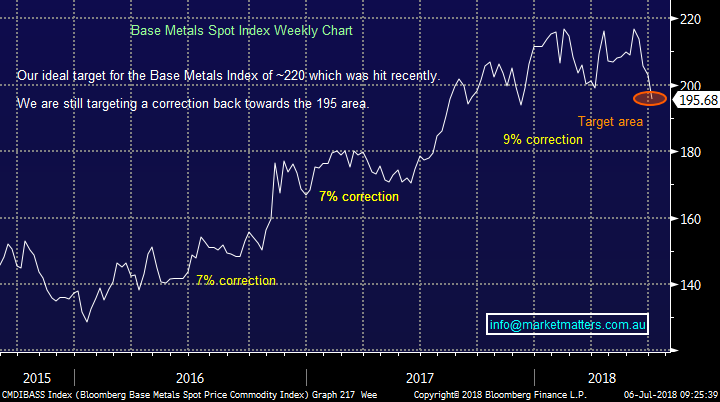

1 Oz Minerals (OZL) $9.14

Copper & Gold producer OZL is a stock we’ve targeted into weakness after leaving too much on the table when we sold at $9.12 back in April. Yesterday the stock ticked below our $9.00 downside target area and bounced quickly and strongly to close at $9.14. Given the weakness playing out in China and the influence this has on the Copper price which was down another ~3% overnight, we’ll remain patient for an entry below $9

We are bullish OZL below $9.00

Oz Minerals (OZL) Chart

2 Bellamy’s (BAL) $12.77

Bellamy’s is an exporter of product to China and was down 9.6% yesterday on concerns around delayed approvals that could negatively impact future earnings. We have been negative on BAL targeting a move below $15, however the selling stepped up a notch yesterday. BAL is now on our radar as a potential buy.

We like BAL into weakness however current selling intensity is high

Bellamy’s (BAL) Chart

3 Dominoes (DMP) $48.92

The pizza shop was whacked 9.14% yesterday on the double broker downgrade, largely on concerns about its franchise model but also on its optimistic earnings guidance for the second half. Dominoes had experienced a sharp run up into June on the back of short covering. The decline yesterday is a warning shot for further likely weakness in DMP.

Technically, we are negative DMP targeting a move to new lows below $38 i.e. ~20% lower

Dominoes (DMP) Chart

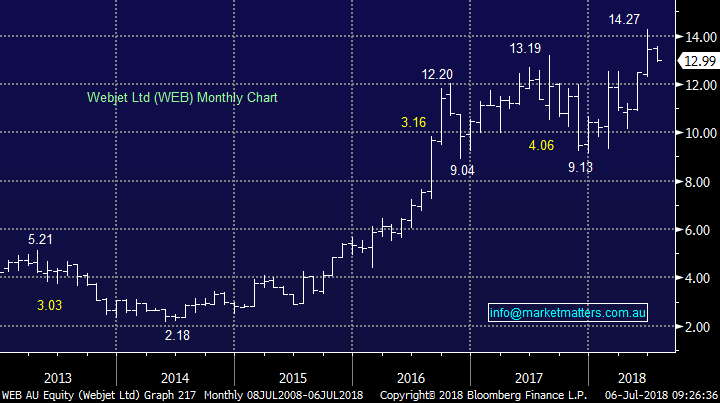

4 Webjet (WEB) $12.99

We sold WEB at $13.11 recently after buying the stock at $9.54, booking a nice ~38% profit on the position. We like travel stocks generally however WEB now looks negative having closed below $13 yesterday. This is a volatile stock and we think an opportunity will re-resent its self at lower levels.

Technically, we are targeting a move back to $10 i.e. ~30% lower

Webjet (WEB) Chart

Conclusion (s)

US starts tariffs today at 2pm our time

Recent weakness in commodities will provide a buying opportunity

We like OZL below $9 and BAL however entry is hard to pinpoint, we have no interest in DMP or WEB at current levels

Global markets

The tech-based NASDAQ continues to be well supported, rebounding from recent weakness.

We remain negative the NASDAQ however recent strength is testing our resolve, A test of the 7500 is a possibility.

US NASDAQ Chart

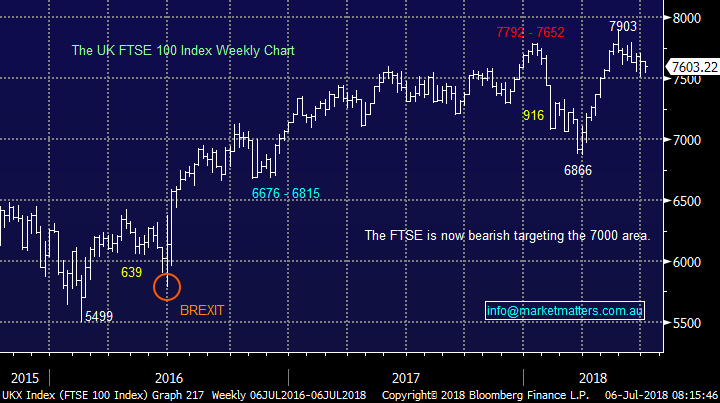

European stocks continue to look shaky and the UK FTSE still looking bearish.

UK FTSE Chart

Overnight Market Matters Wrap

· The US equity markets rallied with both the Dow and S&P 500 posting solid gains of 0.75% and 0.86% respectively, while European markets also firmed. Base metals eased lower, as did oil and iron ore on continuing concerns that any escalation in trade will ultimately slow growth.

· The Nasdaq 100 led the surge on Wall St, rising 1.2%, as investors pushed aside concerns of the first round of the Trump tariffs which are due to take effect on US$34bn worth of China imports over the weekend.

· The bond markets rallied again, with the benchmark US 10yr at 2.83%. Overnight both the Governor of the BoE and the US Fed expressed their concerns that the threat of trade wars was beginning to have an impact on slowing growth.

· The ASX 200 is expected to hit a fresh 9-year high towards, testing the 6250 level this morning as indicated by the September SPI Futures.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here