Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

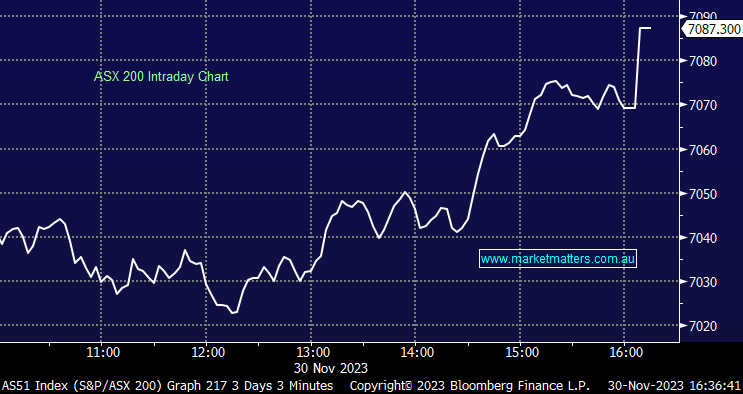

The trend for the week was broken today with the market down early before rallying ~60 points as it squeezed up into month end with an MSCI Index rebalance thrown into the mix as well – the market is starting to get that ‘Christmas squeeze’ vibe about it, the ASX 200 up 4.52% for the month of November, recouping a large proportion of the declines from the September / October, the net result is a total return of -1.4% for the tumultuous period.

- The ASX 200 finished up +51pts/+0.74% at 7087

- The Industrial sector was best on ground (+1.43%) while IT (+1.29%) & Financials (+1.24%) outpaced the market’s gain.

- Utilities (-0.95%) and Energy (-0.26%) the only two sectors to finish lower.

- Utlities weighed down by Origin (ORG) -1.9% after they rejected Brookfields revised offer while AGL Energy (AGL) lost -2.68% capping off a tough month.

- Activity in China’s manufacturing and services sectors shrank in November, which fuels expectations for more stimulus.

- All the major banks we up. Commonwealth Bank (CBA) +1.29% the best of them as loan growth kicked back in.

- Uranium was on the nose, Paladin (PDN) -2.99% followed weakness overnight – couldn’t see much out on this so suspect ETF flows perhaps, they have a big bearing on the stocks.

- Iress (IRE) +14.87% rallied on an upgrade to guidance – more on this below

- Healthcare stocks a standout during November (+11%) after a tough year – Resmed (RMD) +2.27% today looking a lot better, now up ~15% from the lows. Ramsay (RHC) the one getting left behind.

- Ditto for Property stocks as recent investor surveys show more appetite to wade back in to Real-Estate – Centuria Capital (CNI) +28% for the month.

- The BNPL stocks in the US have really started to rock and roll – Block (SQ2), the old Afterpay was up +58% for the month!

- Iron Ore was marginally higher in Asia, +0.34% at $US134.70

- Gold edged was flat during our time zone today, trading at US$2044 at our close.

- Asian stocks were solid, Hong Kong +0.40%, Japan +0.40% while China added 0.34%.

- US Futures are up around 0.20%.

- Snowflake (SNOW US) reported quarterly results after the bell overnight, guiding to revenue growth of 30% (~$721m), which was ahead of expectations. More on this tomorrow – we hold in the International Equities Portfolio, with the stock +7% after hours. 32 buys, 14 holds and 1 sell from analysts.