What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

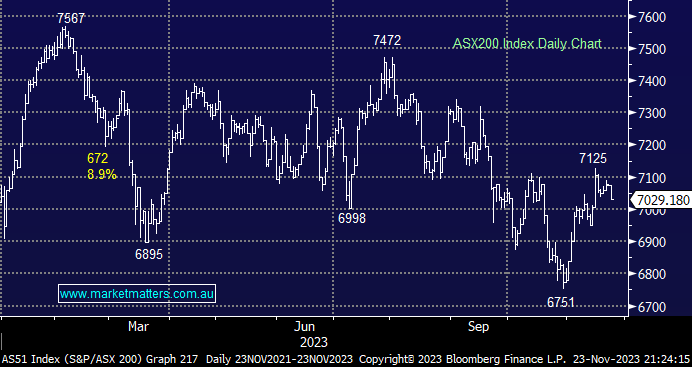

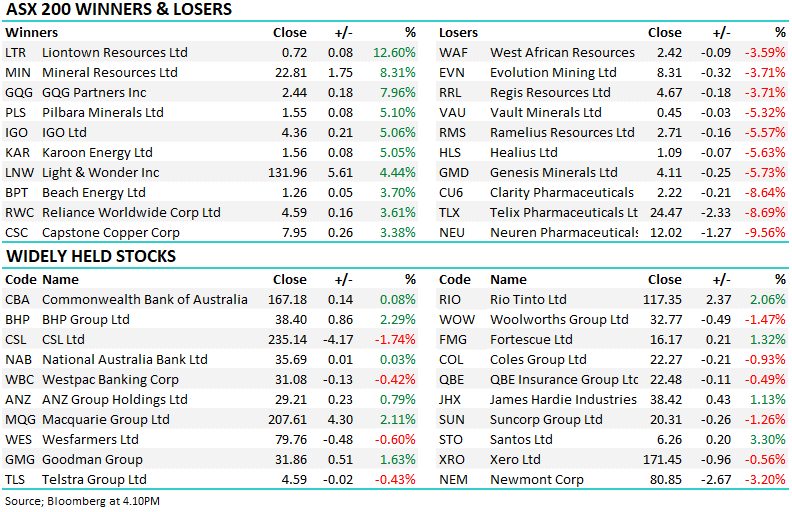

The ASX200 slipped -0.6% on a lacklustre but weak session yesterday that saw less than 35% of the main board close in positive territory, it felt like local investors/traders had decided to embrace the US Thanksgiving Holiday before the Americans! Weakness across the resources space was the main cause of the market decline, with most big names receiving some seller’s attention, e.g. South32 (S32) -3.1%, Fortescue (FMG) -1.9%, Woodside (WDS) -1.7%, and BHP Group (BHP) -1.4%. The day illustrated the major influence of the Resources Sector on the ASX as other indices across the region were firm, the Hang Seng +1% and Japan’s Nikkei +0.3%.

As we mentioned earlier this week, stocks/sectors are jockeying for position, with December looming on the horizon and potentially another ‘Christmas Rally.’ Thursday’s session didn’t deliver any meaningful read-throughs for investors, with both the best and worst stocks on the day coming from the “Dogs of 2023” enclosure, e.g. winners AMP Ltd (AMP) & Healius (HLS) and losers Star Entertainment (SGR) & Allkem (AKE).

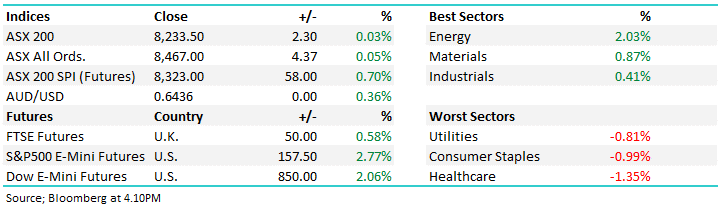

US stocks were closed for Thanksgiving Day celebrations, but a small gain by the S&P500 futures and European indices, which closed up ~0.25%, looks set to provide stocks with a positive tailwind this morning.

- The SPI Futures are pointing to an early gain of ~0.2% this morning following a positive session across Europe.

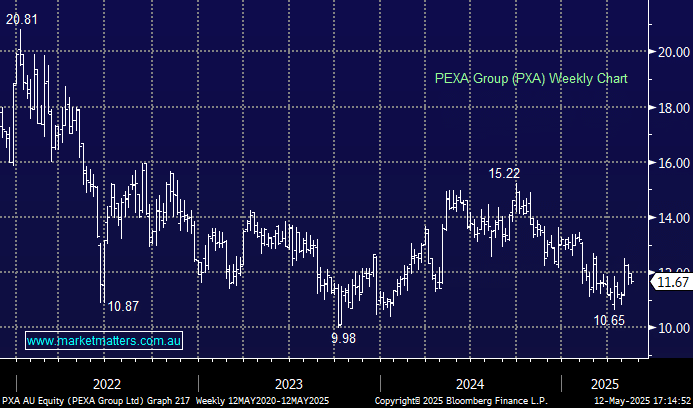

This morning, we’ve revisited three retailers after the Chief Executive and son of the Nick Scali founder, Anthony Scali, sold 4.6m shares, worth just over $50m on Thursday, around 40% of his holding – the question is whether he foresees a tough few years ahead.