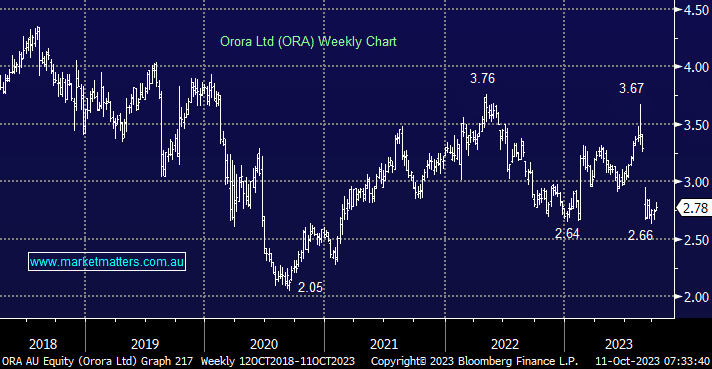

The packaging company has been on our Hitlist for a few months for both the Growth & Income Portfolios, and in that time they announced the significant acquisition of Saverglass, a global manufacturer of highend bottles for the premium and ultra-premium spirits and wine market. It is a $2.2bn acquisition, so its big in both absolute terms and relative to the existing ORA business and this led to a $1.3bn equity raise at $2.70, a 21% discount to the dividend-adjusted last closing price pre-announcement, with the deal completing in the 4QCY23. We’re removing ORA from our Hitlist, for now, while we see how the dust settles on this transformational deal:

- Saverglass is a good company, but big acquisitions are risky, and they take time to integrate and fully recognise the benefits

- ORA have taken on an additional $875m in debt at a cost of 6.5% as part of the purchase.

Important to any acquisition in earnings accretion, or in other words, will the purchase increase the acquirer’s earnings per share (eps) given there are now more shares on issue. In the case of Saverglass, it is expected that it will, but not until FY25, the first full year of ownership. We also consider the market, and how the issue of new shares will impact on-market demand. Investors have just been able to ‘fill their boots’ in ORA stock at $2.70, and the benefits of the acquisition are some way off. While we like the deal, and the company more broadly, we believe we now have time on our side.

- We’re now in no rush to add ORA to either portfolio given the recent acquisition, believing there is a high chance that ORA will simply tread water over the coming months.