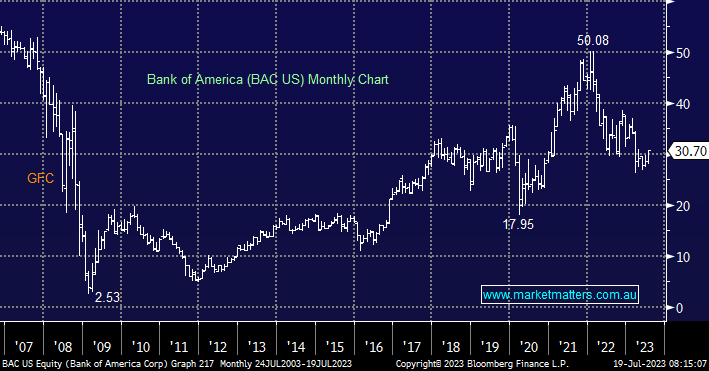

Banks are performing better than expected through what has been a very turbulent time for the sector following a number of regional bank failures. Overnight, Bank of America (BAC US) was the latest to report quarterly results that showed a surprisingly resilient backdrop, a theme that was also obvious in last week’s results from both JPMorgan Chase (JPM US) and Citigroup (C US). In simple terms, bank earnings should be dictated by the difference between the cost of their borrowings versus the rate they lend, minus bad debts & operating costs. Banks generally borrow short via deposits and lend long by writing mortgages, implying that when short-term interest rates are above long-term rates, things are tough and vice versa. At the moment, US 2-year yields are around 1% above 10-years creating an unfavourable backdrop for banks, however, margins are proving resilient. This implies that liquidity (provided by the Fed), remains high and the supportive backstop that has been put in place by regulators remains alive and well.

We’re also seeing strength in other parts of their operations, with revenues from fixed-income, commodities & currencies underpinning solid results. BAC delivered a quarterly profit of $US7.1bn, around 3.5% above consensus driven by revenue that was up 11% on the period. JP Morgan’s Jamie Dimon, who some say should be the next President, said on Friday that the consumer remains in good shape, a comment echoed by Wells Fargo & Citi.

The improving economic backdrop as inflation cools, along with favourable bank results increases the probability of a soft landing, and equities are starting to price this in. What if we don’t have the recession that everyone believes is more or less a certainty?