BKW +3.13%: the building products and investment company reported 1H numbers today which were stronger than expected while outlook comments appeared better than feared. Revenue was up 13% yoy, while Underlying profit added 24% to $410m. The Building Products division saw revenue growth in both Australia & Northern America despite signs the construction market has started to taper off with interest rates. The company talked to a strong pipeline of work to support the 2H. The property & investments book is what ultimately drove the result with further positive revaluations, strong performance from WHSP (SOL) which Brickworks owns 26% of (and WHSP owns 40% of BKW strangely enough) and a new property coming online. They continue to see strong demand in key industrial property markets and expect rental increases to further boost income from here.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

Close

Close

Thursday 5th June – ASX -9pts, CU6, TYR, IPX

Thursday 5th June – ASX -9pts, CU6, TYR, IPX

Close

Close

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

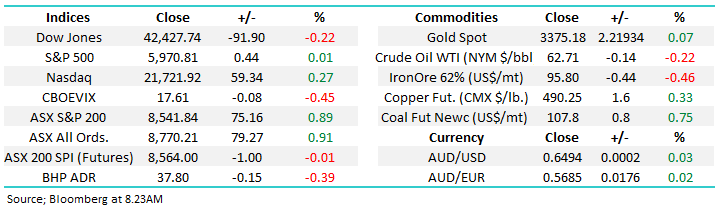

Thursday 5th June – Dow -91pts, SPI off -1pt

Thursday 5th June – Dow -91pts, SPI off -1pt

Close

Close

MM is neutral to bullish BKW

Add To Hit List

Related Q&A

Whats MM’s current view towards BKW please

Does MM like BKW or SOL?

Does MM like SOL &/or BKW?

MM’s thoughts on SOL , BKW and JLG please!

CSR v Brickworks (BKW)

Relevant suggested news and content from the site

Video

WATCH

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

FY26 is shaping up as a year where strategic portfolio positioning will matter more than ever. Hear from James Gerrish & Shawn Hickman as they detail MM's current views.

Podcast

LISTEN

Thursday 5th June – ASX -9pts, CU6, TYR, IPX

Daily Podcast Direct from the Desk

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Podcast

LISTEN

Thursday 5th June – Dow -91pts, SPI off -1pt

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.