I’m sure all subscribers are aware of the collapse of Silicon Valley Bank (SIVB US) and subsequent acceleration to the downside by the US Banking Sector – the regionals have already corrected a painful -56% with the plunge over the last week just an extension of a bearish trend which has been unfolding since early 2022. Global indices and especially those in the US are not as heavily skewed to the Banking Sector as the ASX with the S&P500’s entire Financial Sector only making up just over 10% of the index, less than half of the local market.

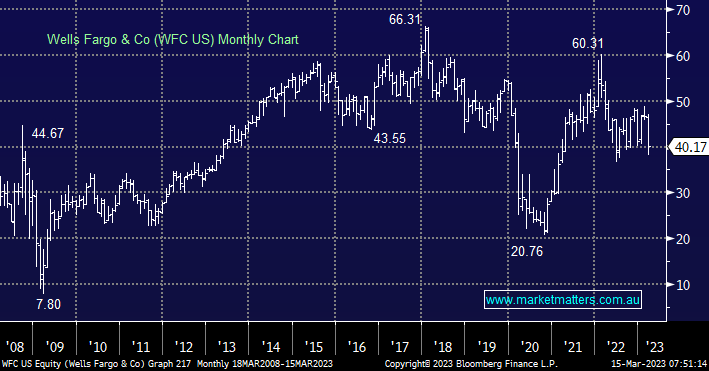

It’s important to appreciate that MM’s 6% holding in WFC is an underweight stance although it’s never nice to see any position drop -14% in one week, but, it could have been significantly worse considering the moves across some of the global banks, not just those in the US. WFC is a traditional bank per se that offers retail and wholesale banking plus wealth management hence we don’t see any of the issues that crippled SVB arising here but the stock is likely to struggle to breach $US50 over the coming months.

- MM is not planning to increase its US Banking exposure although short term our preferred scenario is a bounce is close at hand.

We believe maintaining an underweight stance towards global banks makes sense with WFC one of our favourites in today’s environment although we are scanning the US regionals for companies who are sound but have been caught up in the panic sell-off following the demise of SVB.