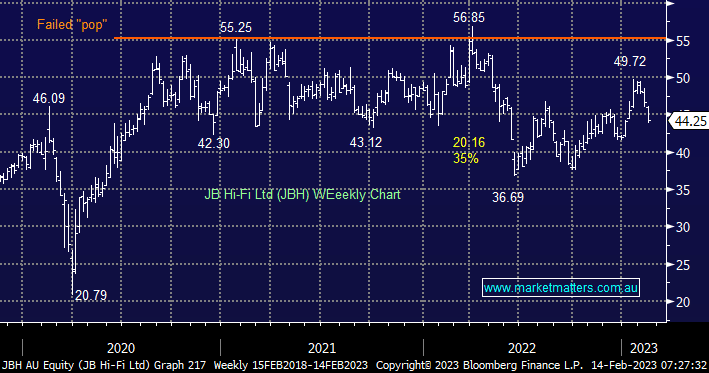

JBH fell over -5% yesterday following its 1H23 results which were solid but the outlook dampened investors’ enthusiasm i.e. the company gross margin beat expectations, the dividend was lifted over 20% to $1.97 but looking forward to a potential rate-induced recession is clearly bad news for this seller of electronics.

- We like JBH as a business as do most analysts with only one sell recommendation out of 15 opinions but it all comes down to what price to pay.

JBH is cheap trading on an Est P/E of 9.8x plus its forecast to yield 8% over the net 12 months kicking off with a $1.97 fully franked dividend in 9 days’ time but markets are forward-looking and if conditions are likely to sour it can very quickly get much cheaper.