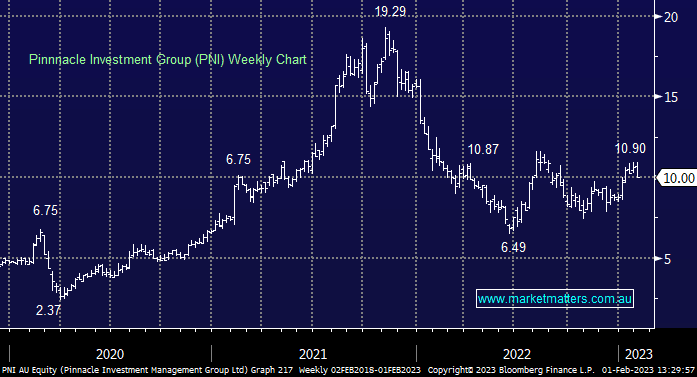

As discussed in recent reports, we have shifted to neutral on Pinnacle (PNI) after a strong rally. We have reservations around FUM flows heading into half year results and are using the recent rally to lock in profits on our 4% weighting.

scroll

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

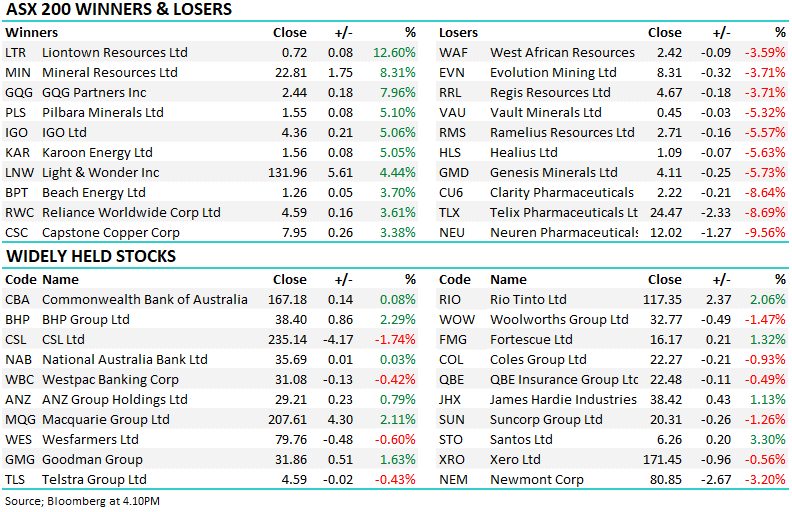

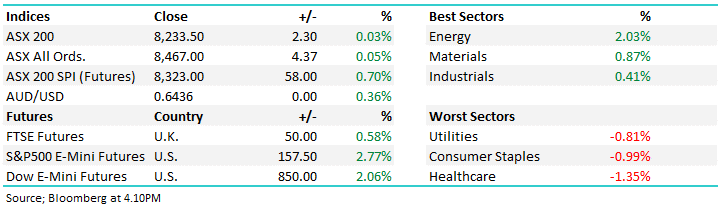

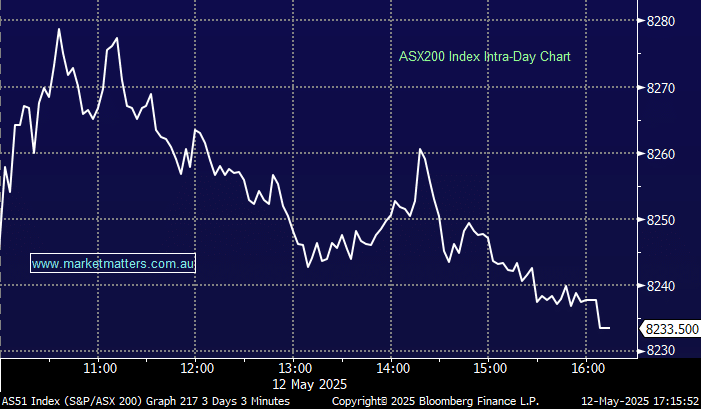

Monday 12th May – Dow down -119pts, SPI up +16pts

Monday 12th May – Dow down -119pts, SPI up +16pts

Close

Close

MM are selling PNI in the Emerging Companies Portfolio, taking profit around $10

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on PNI

MM, why the negative view on PNI?

Thoughts on Fund Manager sentiment and PNI?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Monday 12th May – Dow down -119pts, SPI up +16pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.