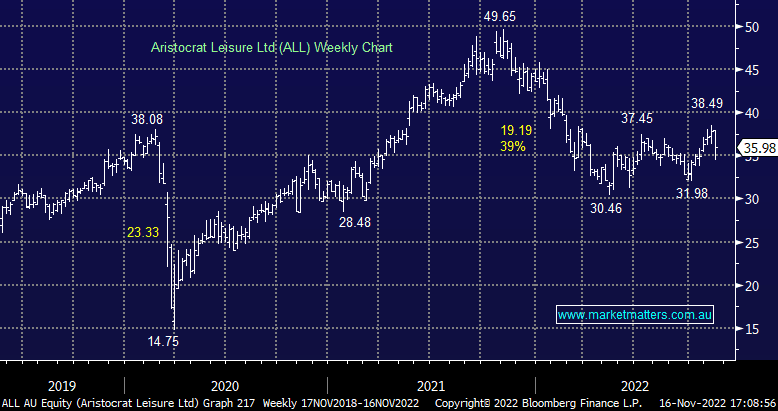

ALL -5.02%: Was weaker today following their FY22 results that were inline with expectations. Revenue of $5.57bn was +17% on FY21 and inline with consensus while underlying net profit was up 27% and also inline. The issue stemmed from the outlook with the company saying that they expect earnings to be higher in FY23 than FY22, although they failed to put a number on it (the market was positioned for +13%) while they went on to site some challenges in bookings from Pixel United compared to recent years. We’d expect some downgrades to flow ion the back of this.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is now considering selling ALL

Add To Hit List

Related Q&A

LNW

Thoughts on Aristocrat (ALL) and National Storage (NSR)

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

Does MM believe Aristocrat (ALL) a buy here?

Thoughts on Aristocrat (ALL) and PointsBet (PBH)

Short term price targets for various stocks

Is it time to book profits in CBA & ALL?

Technical setup for ALL

ALL, CTD, CGC, A2M

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.