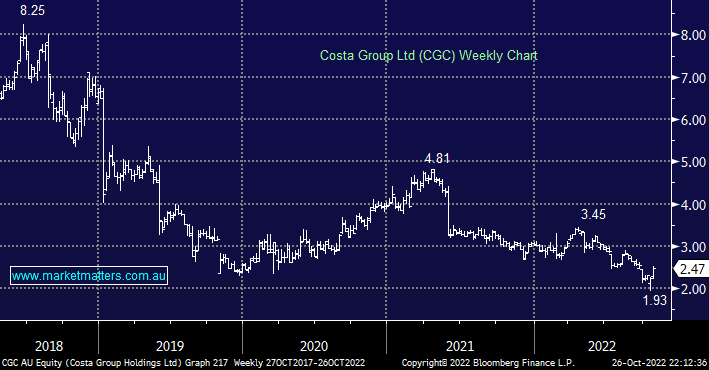

CGC closed up +10.8% yesterday as the fruit and veg company jumped to a 1-month high as US Private Equity Fund Paine Schwartz took their stake up to 15%, primarily through a block trade at a 16% premium to the previous close i.e. at $2.60. Importantly the fund won’t be able to take its 9.9% direct position any higher without FIRB approval and said they have no intention of a takeover.

- Paine lifted its CGC exposure, as opposed to direct holding, above the 9.99% FIRB level through a return swap & forward, a bit like an option.

- From Paine’s broker Cit “At this stage, the shareholding is seen as a long-term investment and the Acquirer has no current intention of making an offer to acquire control of CGC.”

The move feels opportunistic after the recent downgrade by CGC but not necessarily a good reason to go long although the risk/reward would start to look attractive around $2.25, or 10% lower – but it is a tough stock to own!