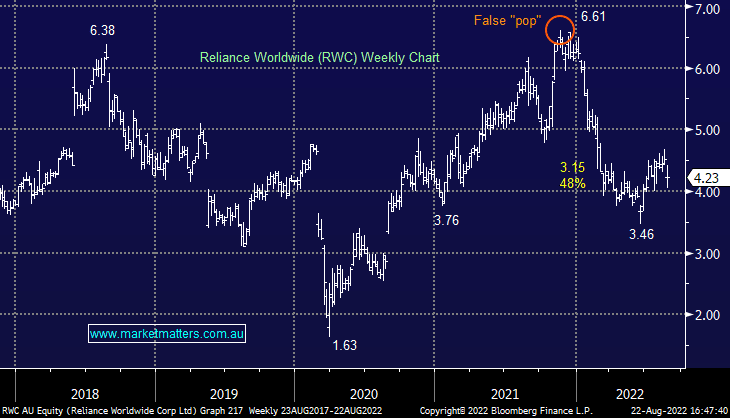

RWC -6.21%: The supplier of plumbing parts was down as much as 10% at its worst today on a result that looked at least in line with expectations. Net sales of $US1.17bn were online with consensus while adjusted net profit of $137.4m was 2% lower than FY21 but in line with the $138m expected. They said that while the short-term outlook is “satisfactory” the medium-term outlook is uncertain, although we think that RWC’s focus on repairs should position better than others through any downturn. One obvious risk is the destocking from wholesalers who bought up big at the end of FY22 due to supply chain issues and that should have a negative impact at the start of FY23. They also talked to higher commodity costs for key materials including copper, zinc, resins, and steel, along with freight, packaging, energy and other cost inflation. They said average price increases across the group of about 9.5% were achieved during the period, with price rises implemented in all key markets helping to offset cost increases. That has been an obvious theme through this reporting season where consumers have (so far) handled higher prices.

scroll

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral RWC ~$4.20

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.