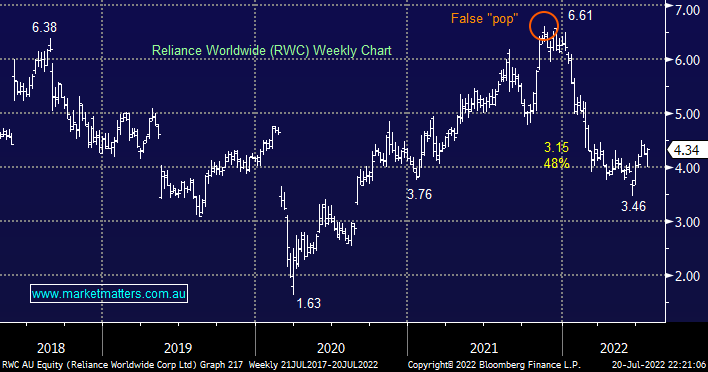

This plumbing business has been out of favour since late 2021 having endured a 48% correction with higher input costs plus the common concern around the strength of the consumer as interest rates rise weighing on the stock. With revenue estimated to grow by over 9% to $1.304bn in 2023 we feel the stocks fairly cheap on an Est P/E of 16.4x for 2022.

- The stock looks very capable of heading towards $5 short-term but medium term it’s not overly exciting for us.