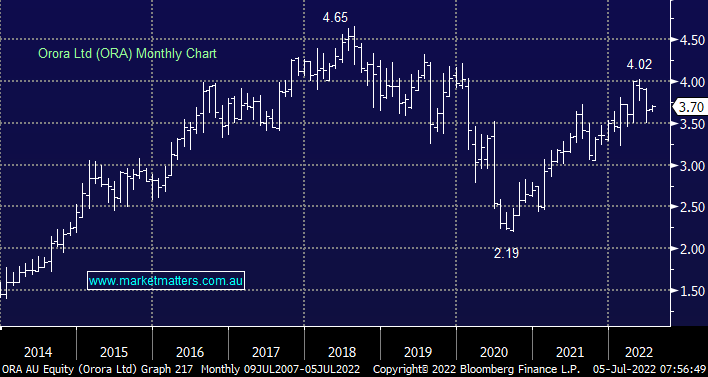

Packaging business ORA has slowly but surely appreciated since COVID, a very comfortable journey compared to many stocks & sectors in 2022. We believe ORA is reasonable value trading on an Est P/E of 17.7x for 2022 while its 4.2% unfranked yield is a useful top-up for performance. The company is growing in North America while inflation has been navigated by timely price increases i.e. the business has pricing power. For good measure sustainability trends are aiding demand for ORA’s cans and fibre packaging solutions, while it stays ahead of the curve in this department things look solid for ORA.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bullish ORA looking for an eventual test of $4.50

Add To Hit List

Related Q&A

Thoughts on RHC and ALX

Thursday’s Morning Report Comment on AMC and ORA

ORA

Update of MM’s Webinar – “Pulse check 7 Highest conviction calls”

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.