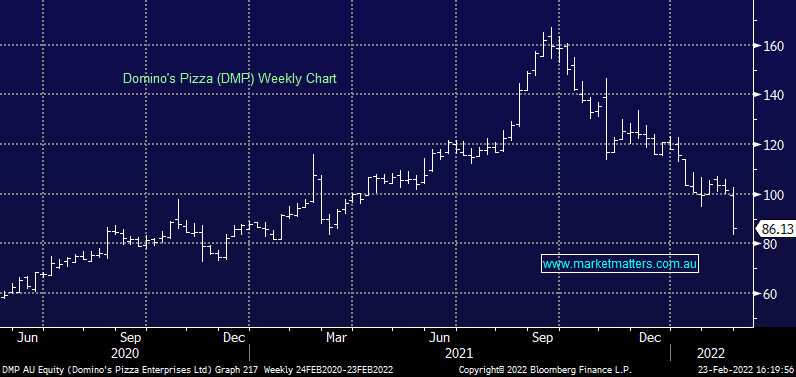

DMP -14.02%: A tough session for DMP today following a miss on their 1H22 results. Profit for the half was around ~6% below expectations while same store sales (SSS) growth for the start of CY22 is tracking at 1.77%, below their longer term target of 3-6% range. Worth noting they are coming off a strong comparable period and it was widely expected that SSS would miss, just not by that margin. In any case, DMP has fallen from ~$165 to now trade sub $90, we would have thought a portion of todays result was factored in however the SP decline clearly shows otherwise. While we don’t think this is the time to be stepping up and buying misses, DMP looks interesting and is certainly now back on the MM hit list.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM has now added DMP onto our Hit List – sub ~$90 looks interesting

Add To Hit List

Related Q&A

DMP/CKF as possible growth/dividend stocks

DMP & Chemist Warehouse

Does MM like Dominos (DMP) capital raise?

Does MM like CKF &/or DMP?

What are MM’s thoughts on Domino Pizza?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.