- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

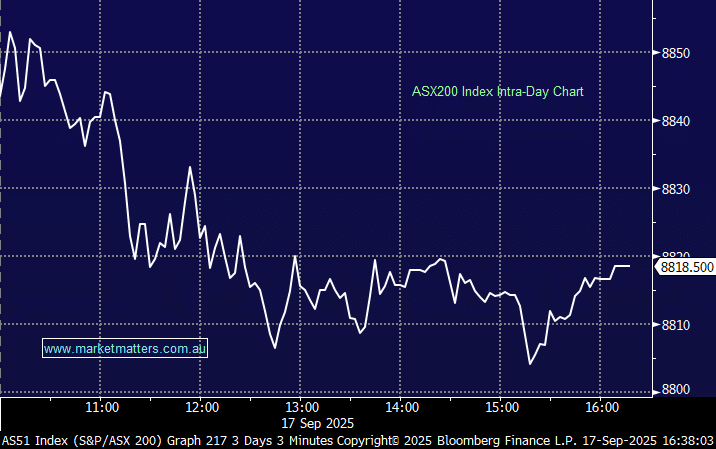

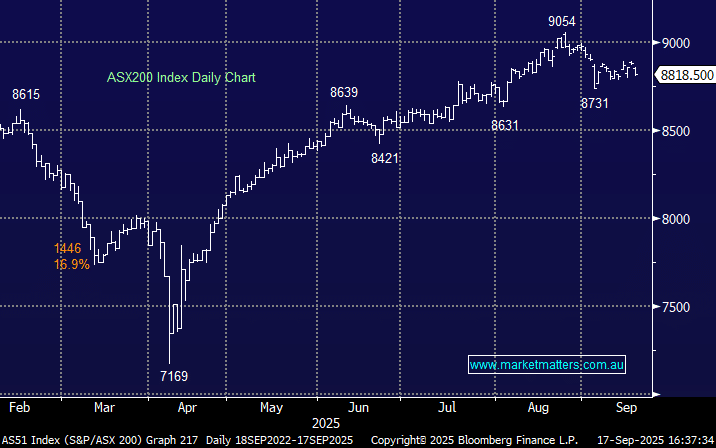

The ASX gave back ground today after opening only a touch softer; selling quickly set in as traders sat on their hands amid a general risk off feel ahead of the Fed’s rate call tonight. The sharp selloff was met some buying at the ~8800 level, bouncing midmorning but tracked sideways into the afternoon. Property and miners bore the brunt of the selling, though gold was no safe haven either with profit-taking kicking in despite bullion briefly touching fresh highs. We expect more action tomorrow with it all hinging on the Fed’s decision to stick with the widely expected 25bp or go for an outsized 50bp cut… and while unlikely, we can’t rule out the possibility of no cut at all.

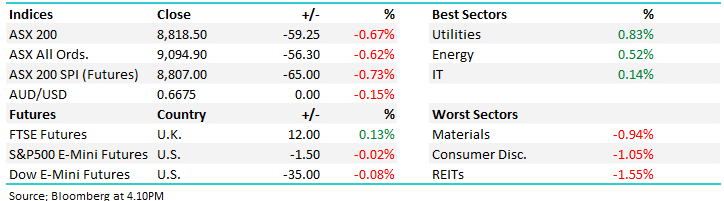

- The ASX200 fell -59pts/ -0.67% to close at 8818.

- Utilities (+0.83%), Energy (+0.52%) and Technology (+0.14%) the only 3 sectors higher on the day.

- Real Estate (-1.55%), Consumer Discretionary (-1.05%), and Materials (-0.94%) weighed.

- Wesfarmers (WES) -1.88%, Harvey Norman (HVN) -2.04% and JB Hi-Fi (JBH) +0.14% led consumer stocks lower despite upbeat UBS data pointing to the strongest spending intentions since 2019.

- A mixed day across the materials sector with BHP (BHP) -1.13% lower as it gets set to cut 750 jobs in Queensland in a response to weak coal prices and what it believes are high royalty rates to the state government. Rio Tinto (RIO) -0.99% was down among others on softer iron ore futures.

- Rare earths were a bright spot on news the U.S government was in talks to set up a $5bn investment into miners in the space – Lynas (LYC) +0.91% and Iluka (ILU) +1.62% both with good sessions on a down day.

- Woodside (WDS) +1.32% managed a decent gain while Beach Energy (BPT) +2.09% and Karoon (KAR) +2.72% outperformed on stronger oil prices.

- DroneShield (DRO) +1.91% secured a $7.9m in new US Defence Department contracts and jumped off the open up ~8% but was quickly brought back to earth in light of its lofty ~$2.8bn market cap.

- Corporate Travel (CTD) remained in suspension as it flagged further delays to its full-year accounts, now expected in November after lingering audit issues tied to its European business.

- Asian markets were mixed, with Hong Kong up +1.6%, China firmed +0.4% and Japan was -0.1% lower.

- Gold traded down -$US11 during the session to $3678 around the close.

- Iron Ore in Singapore down a touch, now trading $106/mt at our close.

- US futures are trading mildly lower.