The ASX200 put in an extremely impressive performance yesterday rallying +0.57% posting its highest level since May in the process, all after the Dow had tumbled more than 600 points following weak economic data (Retail Sales & Producer Price Index). On Thursday we saw Australian unemployment unexpectedly nudge higher to 3.5% while the participation rate dropped 0.2% following a surprise drop in employment, as would be expected bond yields fell as investors hoped for the end to rate hikes sooner rather than later. Under the hood the story remains a touch clouded:

- Local 10-year bonds fell to 3.32%, almost a full 1% below their October high.

- However so far in 2023 the resources have led the ASX200 higher while the interest rate-sensitive tech Sector has been the 2nd worst-performing sector.

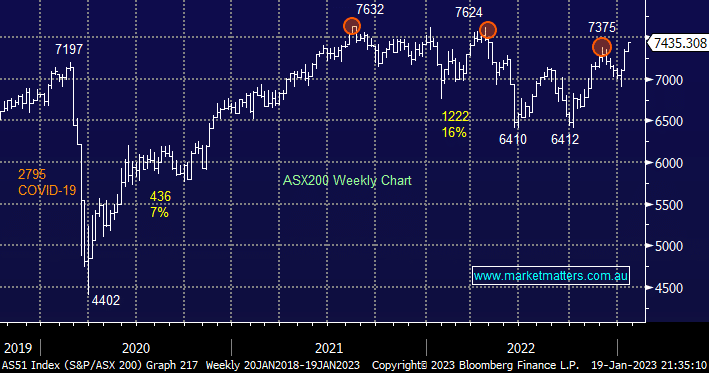

On the stock front, Thursday’s rally wasn’t broad-based with only 50% of the main board advancing but when CBA, BHP and CSL rally an average of 1% the ASX200 is likely to follow suit i.e. refer back to Tuesday’s What Matters Today Report. The upside momentum of the Australian market cannot be questioned and we can see a test of 7600, or even fresh all-time highs, in the coming weeks i.e. now less than 3% higher.

- Investors have been net bearish equities for months and we don’t feel this has overly improved even as stocks have rallied over 15% since October, a contrarian bullish indicator.

US markets slipped lower overnight on renewed concerns that the Fed would continue with its aggressive rate hiking cycle potentially sending the economy into a recession. Overnight data showed the US Labor market was still tight which could provide the Fed with enough reason to send Fed Funds Rate towards 5% over the coming months. Another poor close saw the S&P500 close down -0.76% but the SPI Futures are calling the local market to start the day flat helped by BHP which rallied ~15c in the US.