What Matters Today in Markets: Listen Here each morning

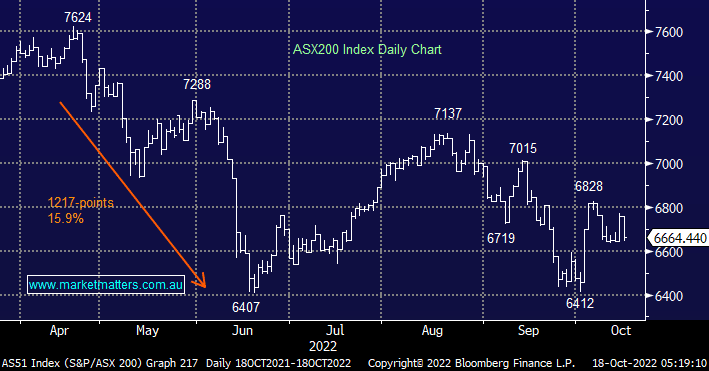

The ASX200 surrendered most of Friday’s gains yesterday as the market continues to rotate in the 6500-6800 region, it was the heavyweight resource stocks that weighed on Monday while the banks continued to look solid. Weakness was not too broad-based with 20% of stocks advancing but with BHP Group (BHP) -2.3%, RIO Tinto (RIO) -2.6% and CSL (CSL) -1.3% it’s hard for the index to perform on the day.

Asian indices fared better than our own with both China and Hong Kong edging higher as Xi Jinping’s looming 3rd term appears to have little influence across the region, potentially his ambitious economic plans are trumping the concerning Taiwan rhetoric. China might be single-minded in its actions and direction but a 20% youth unemployment figure combined with a spluttering economy as The Party maintains its zero COVID policy feels too much to ignore and further stimulus feels likely over the months to come even if it’s not yet being openly discussed.

Star Casino (SGR) caught our attention yesterday as it appeared to enjoy the tag of being “too big to fail” after being fined $100mn and having its licence suspended but it can continue to operate under the supervision of the NSW casino watchdog, not surprisingly the stock rallied on the news which has little impact on the business i.e. the company can still book profits and repay debts taken on to pay the $100mn. The watchdog said they didn’t want to tip Star’s 8000 employees onto the street which makes total sense although I’m sure the board are relieved to have garnered only minor scrutiny.

US equities enjoyed a strong session overnight with the Dow closing up 550-points pointing to a solid +0.9% opening locally. The tech stocks led the rally with the NASDAQ gaining +3.5% after the UK government’s tax and spending plan reversal sent UK 10-year yields tumbling -0.36% – Liz Truss is certainly trying everything in her power to keep her job!

- MM still believes the ASX200 is set to test the 7200 area into Christmas, after the latest dip now ~8% away.