Today I turn 40, I’m not normally big into birthdays however they say this one is meaningful, a time for reflection, to focus on what comes next. For me, hopefully, more of the same with a few more camping holidays, a bit more time with the kids, and I also feel like I need some adventures, things that offer a challenge both physically and mentally and that’s going to be a priority over the coming years. For Market Matters and our wider investment management business, there are some really exciting developments about to happen. Our vision for Market Matters has always been to create a great digital advice platform that makes getting accurate, concise, and timely market intel available to all. Following on from the redevelopment of the website about a year ago, we’ve recently kicked off a new project bringing data into the site that includes full fundamental history on Australian & US stocks, broker forecasts & advanced charting, creating a level of depth and context to our Opinion + Action framework that was missing. This is a really exciting project and one I’m sure you’ll love, with a launch date in the coming months.

We’re also about to launch Market Matters Invest – a simple, streamlined platform that allows direct investment into our portfolios, supported by a great digital experience either online or via an app. And finally, our investment management business (via Shaw & Partners) provides a unique approach to direct portfolio management, servicing those subscribers that want us to manage their portfolios for them.

I’ve got a great team in place with a few more additions to come and frankly, I’m really excited for what comes next. Thanks to all our wonderful MM subscribers & portfolio clients, we’ll keep working hard for you!

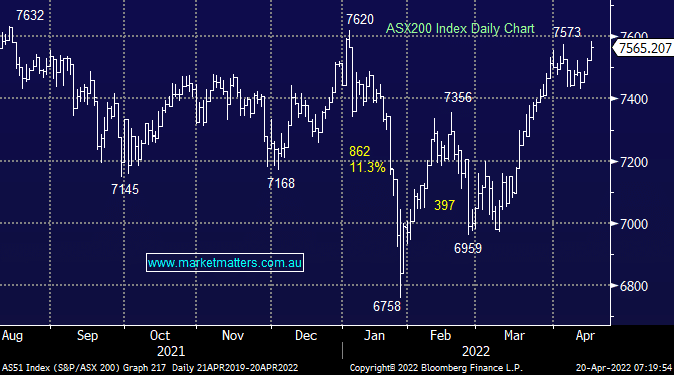

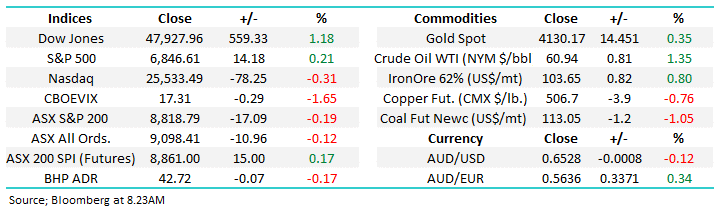

Now to markets, it was a solid start to the shortened trading week yesterday with the ASX 200 inching another 0.56% towards all-time highs, a milestone that may be challenged this morning following a solid session in the US overnight. The minutes were released from the RBA’s most recent policy meeting, and while they kept rates unchanged at 0.10%, it seems to MM that a rare rate hike before the election is now the likely scenario, and rightly so. That caused some concern in sectors that are influenced by higher interest rates yesterday, however, we continue to believe that we’re nearing an inflection point that should see a change in relative sector performances with small caps & technology taking the performance mantle from the value parts of the market, in the short term at least.

Overnight, US stocks enjoyed a broad-based rally with all sectors bar Energy ending the session higher. The Nasdaq led the line up over 2% despite bond yields also creeping higher, the US 10-year yield only 7bps below 3%, its highest level since 2018. SPI Futures imply a strong start locally up 47 points challenging all-time highs, however with BHP down 0.66% in the US, the resources & energy sectors are likely to underperform.