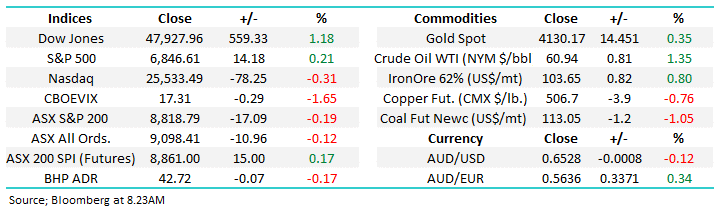

Firstly, I hope you all had a great Easter break, a beautiful 4 days in Sydney where the sun was certainly appreciated. The ASX 200 added +0.61% for the shortened week with Gold & Travel-related stocks populating the leader board. We’re now 19 days into the market’s 2nd strongest month of the year with a gain of just 0.32% to speak of. The ‘old world’ is smashing the new with Utilities up 5.44% while the Information Technology sector languishes, down another 4.01% for the period. Bond yields the major influence on respective sector performance however as US quarterly reporting season heats up it’s important to remember MM’s preferred path for the coming period.

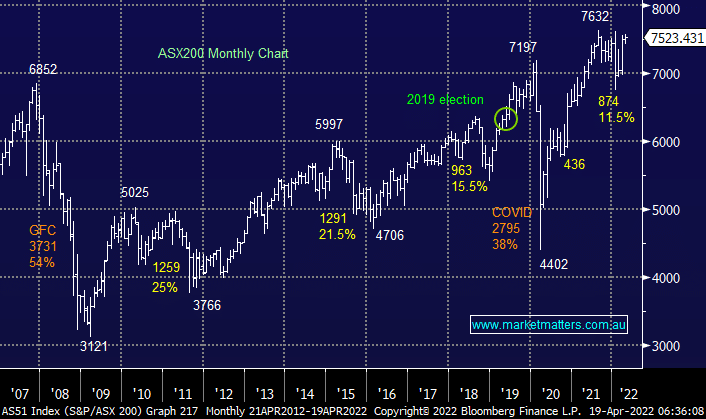

- While April has been positive to date, the gains are below the 2.88% 10-year average with a 90% strike rate of positive returns. We still think the market squeezes up to all-time highs, not a huge call given we’re only ~100 points / 1.4% away.

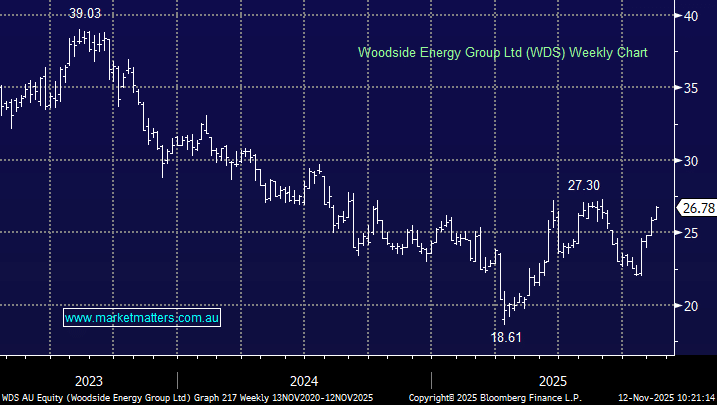

- After anticipating strong outperformance from the banks & resources in early 2022 we think it could be a very different tale as Q2 wears on with the “easy money” this year for the value Sector behind us.

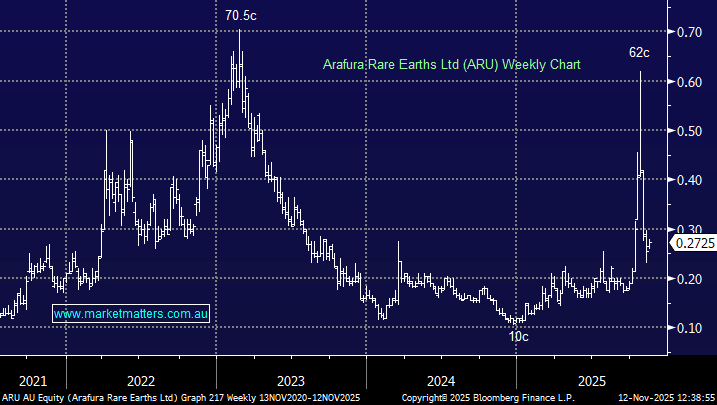

Our Flagship Growth Portfolio has already started to pre-empt this move with a sharp reduction in our holdings in resource stocks during strength in March while we used the Bond-inspired rotation out of growth to selectively increase our exposure for what we believe comes next. Picking tops is notoriously difficult and selling too soon can be a common scenario, however, the ‘long Resources’ trade is now a very crowded one susceptible to sharp corrections. Lithium stocks are at the pointy end of the resource sector and last week showed signs of a short-term top at least as some money transitioned from growth commodities into defensive ones, Gold the major beneficiary trading back up towards $US2000/oz.

Overnight, US stocks came back online while most of Europe enjoyed an extended break. Trading was light with US stocks ending little changed. SPI Futures are suggesting a 10 point rise for the ASX this morning however our futures closed at 1am on Friday morning when the US market was around 0.8% higher than it finished overnight.