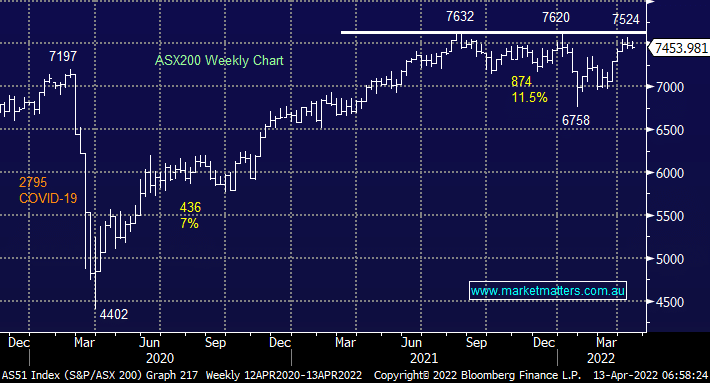

The ASX200 disappointingly reversed some early optimism yesterday to close down 0.42% however there was a lack of interest in the market shown through light volumes ahead of the Easter break. Despite this continued consolidation, MM’s view is unchanged into the end of April / early May:

- We remain bullish equities into seasonal strength looking for a ‘pop’ higher for the ASX 200 breaking out of its current trading range above ~7630, best guess targets sit 7700/7800.

- This is not a move we intend to chase, it’s one to fade and subscribers should expect a further transition down the risk curve for portfolios.

- We think May/June will be tougher for equities setting up some nice overall buying opportunities for the latter part of the year.

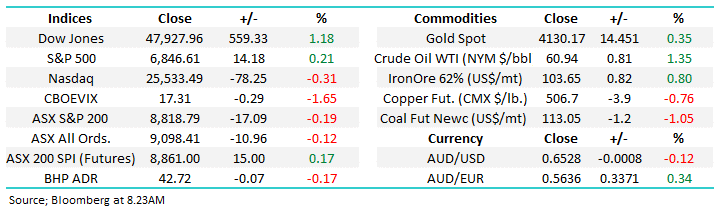

Inflation data took centre stage in the US overnight and while the 8.5% rate for March was a touch ahead of expectations, it seemed the market was positioned for more, plus there were some tentative signs that pressure on key components within the data is starting to ease. Bond yields fell and stocks started the overnight session on the front foot however a 6.3% surge in the Oil price prompted an about-turn in stocks pushing major indices lower by the close.

As we often say, rubber bands stretch too far in either direction at different points in time, and we believe this is the case in bond markets. Traders have priced aggressive rate hikes sending bond yields soaring. While rates are clearly going higher, the market is ahead of the curve, for now at least, and our view remains that yields will pause/consolidate the recent advance. Today will see our friends across the ditch raise rates for a fourth straight meeting, a 25bps the likely scenario taking their benchmark to 1.25%, a far cry from our own 0.10%. The Bank of Canada is also on the move today with a 50bps hike almost fully expected.

Having been up 50pts at 11pm last night, SPI Futures are now pricing an unchanged start to local trade, commodity prices were higher underpinning a 1.5% rise for BHP in the US.