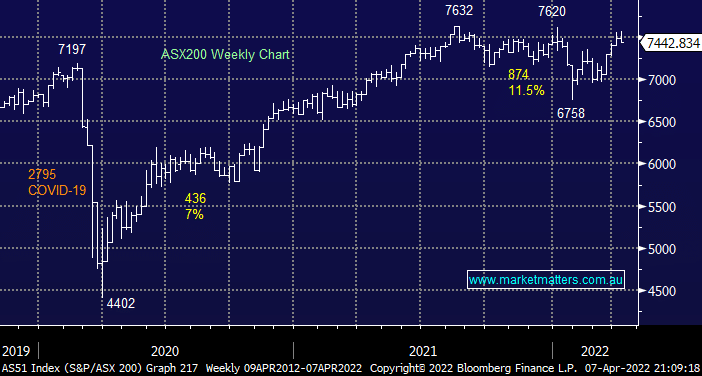

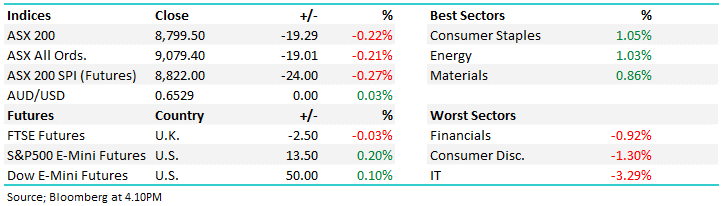

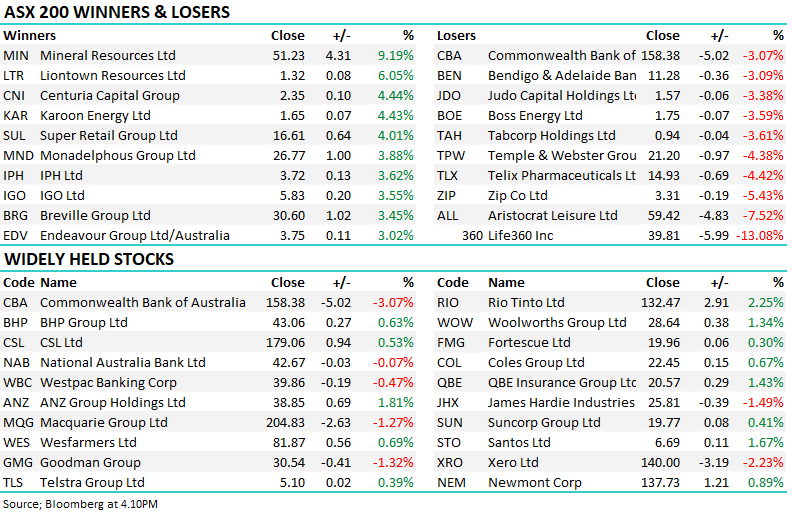

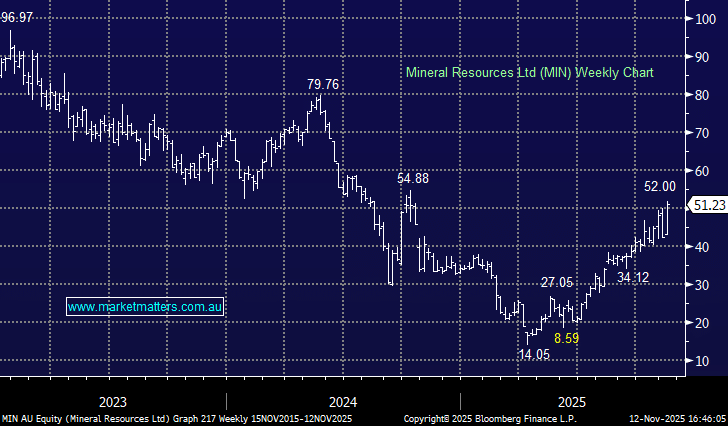

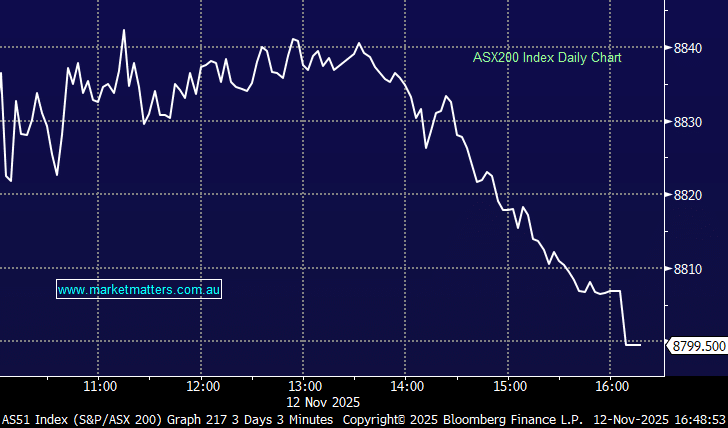

The local market endured a bad day at the office yesterday falling -0.6% as we followed the US futures lower through both their day session and again during our day time / their overnight session. Over 70% of the mainboards stocks slid on Thursday but it was again the growth stocks that weighed the most on the ASX with all members closing lower leaving the overall sector down -3.5%, ultimately it was a fairly uninspiring day that saw the SPI Futures close where they were trading at 10am.

We feel like bond yields are becoming an increasingly major part of our reports featuring on an almost daily basis but markets have a habit of moving on to pastures new when it comes to factors that exert the most influence on stocks – it’s a contrarian thought but perhaps before the end of this financial year we will already have moved on from the geopolitical tensions in Ukraine and soaring bond yields/inflation – as we always say remain open-minded especially when markets feel like it’s become a one-trick pony e.g. it was easy to make money from BNPL stocks and Bitcoin until one day! Our best guess would be it’s time for China to rear its head again but also a few poor economic prints would quickly have economists doubting their new very hawkish outlook.

Things have gone relatively quiet on the commodities front compared to this time last month, statisticians could easily play with the numbers and make it sound like a deflationary cycle!

- Lumber has almost halved from the dizzy heights reached in May 2021 and it’s down 23% in 2022.

- Brent crude oil has fallen 25% from its March high although it’s still up around the same amount year to date.

- Wheat has fallen 24% from its mid-March high although again it’s still up solidly year to date.

MM is leaning towards the 2022 top for commodities being already in place especially considering the macro influences at play and the markets single-minded view that rampant inflation is the path ahead leaving the contrarian in us cautious about jumping on the same bandwagon as everyone else. Subscribers should remember that Fund Managers are holding a record exposure to commodities / crude oil, when the music stops playing we will see a sharp correction in this sector.

Overnight we saw US stocks bounce solidly even as US 10-year and 30-year bond yields rose to their highest level since 2019, as we’ve said for many months rates are going higher the only question is how far & how fast. Healthcare led the gains in the S&P500 as we again saw sectors reverse the previous day’s move, the SPI Futures are calling the ASX200 up 0.5% this morning, basically regaining yesterday’s losses in the process.