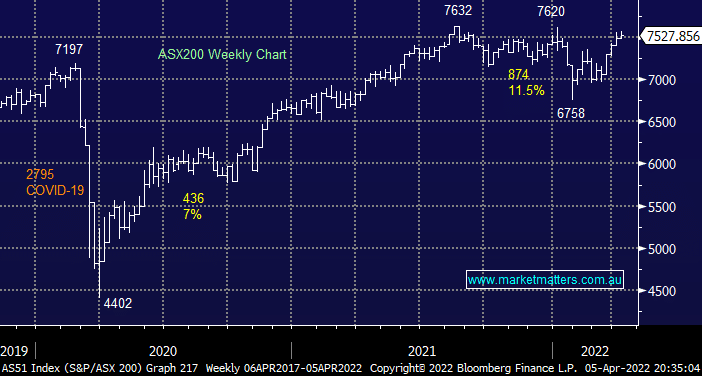

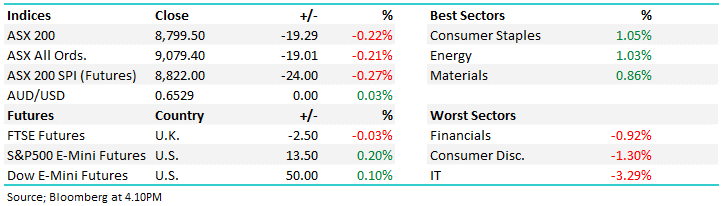

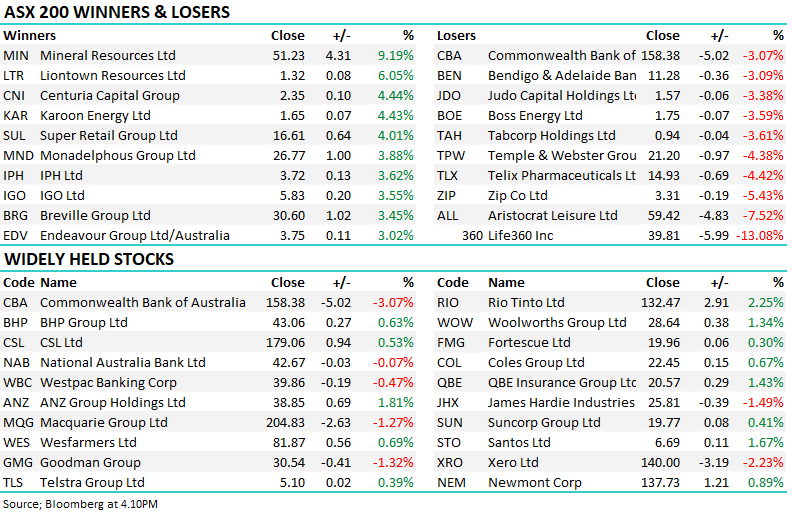

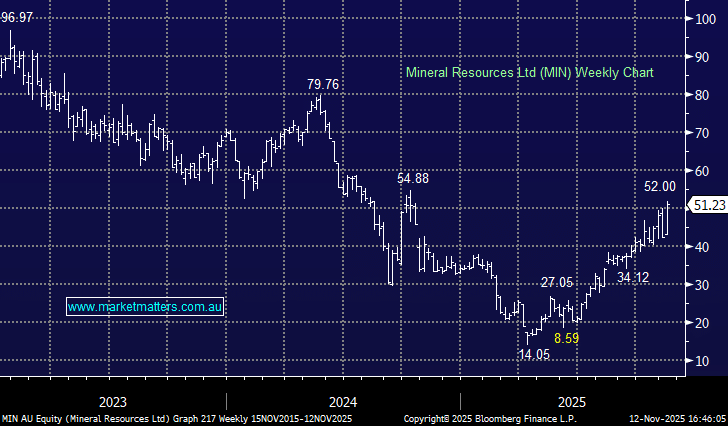

Yesterday saw the ASX200 surrender most of the days early gains following the RBA’s interest rate decision and accompanying rhetoric but it still managed to eke out a +0.2% gain as the local index inches ever closer to an all-time high, now only 1.3% away. The Tech Sector followed their US peers higher on Tuesday ending the day up +3.15% with every stock in the main board’s sector closing up on the day – MM is still looking for the growth names to outperform over the coming weeks/months but rotation keeps threatening and failing to follow through.

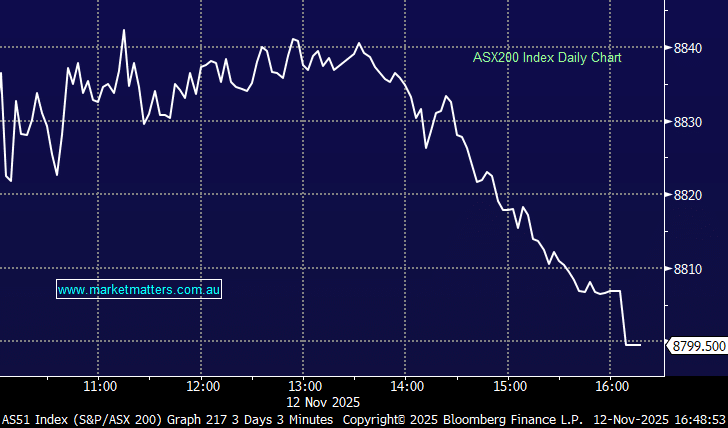

At 2.30pm the RBA took centre stage and in a few minutes they managed to drop the ASX by about 0.5% with their words, as opposed to actions:

- The RBA left the Australian Cash Rate at 0.1%, its lowest level in history, even as inflation surges around the globe.

- The RBA keeps waiting for wages to start increasing but we believe they’re simply delaying the inevitable – they should listen to Nike and “Just do it” importantly then hopefully avoiding aggressive hikes down the track.

- However they removed the word “patient” when it comes to hiking rates suggesting they are approaching fast – here they come!

- Following the hawkish comments the $A rallied above 76c to its highest level in over 9-months

In our opinion Phillip Lowe and Co should already be on the front foot raising interest rates although I’m sure Scott Morrison is glad they aren’t, the RBA is waiting to see “actual evidence” that inflation is sustainably within their target 2-3% range before raising rates. Everybody knows inflation is rising just fill up the car or go to the supermarket and even if it does plateau here how can they possibly justify rates being at the emergency settling of 0.1%, it provides zero flexibility for the central bank if the economy worsens in the future and rate cuts would be appropriate.

Overnight saw US stocks fall following hawkish comments from the Fed plus another round of economic sanctions on Russia feels imminent. A three-year high in US 10-year bond yields weighed on the tech stocks with the NASDAQ closing down -2.2%. The SPI futures are pointing to an initial 50-point drop by the ASX200 with BHP falling around 2% in the US pointing to a weak Resources Sector.