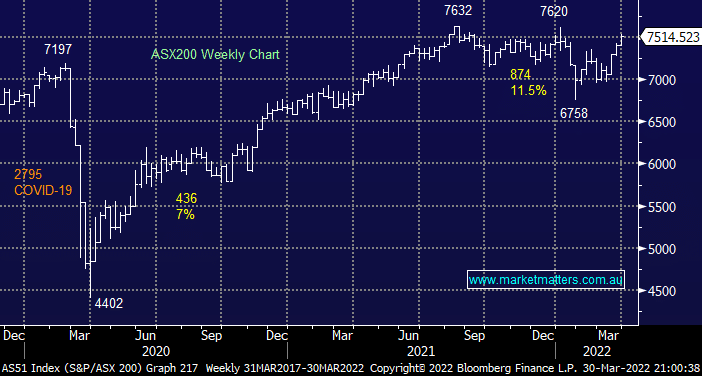

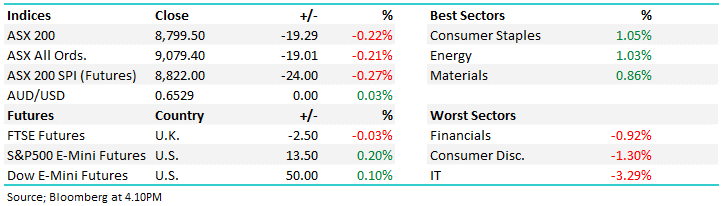

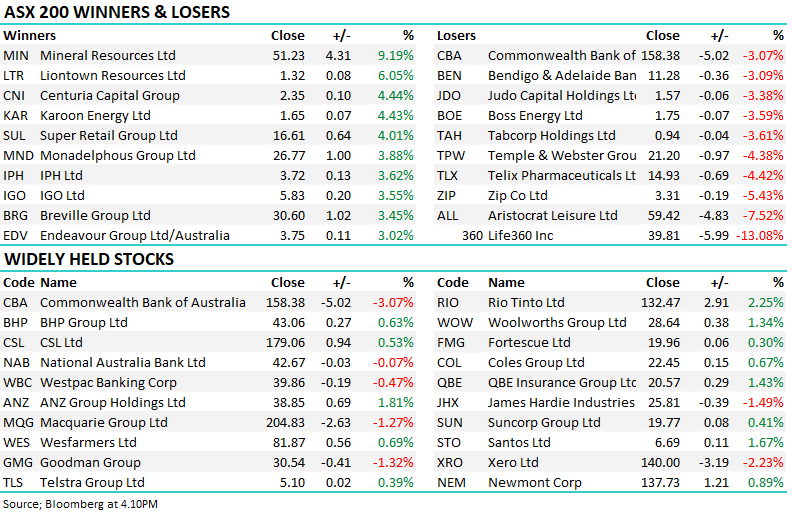

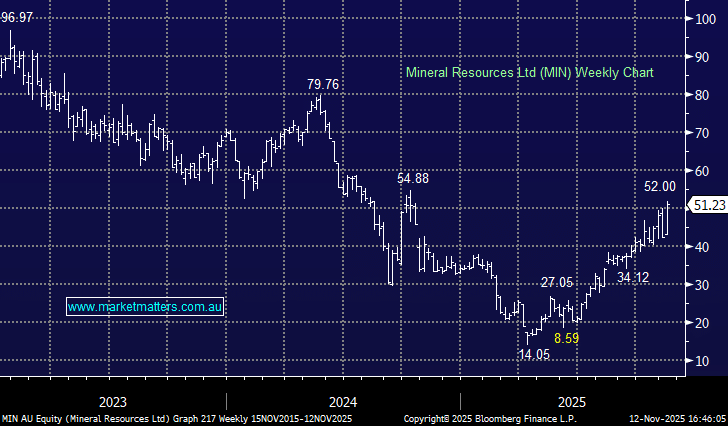

Wednesday saw the ASX200 continue its march towards new all-time highs finally closing up another 50-points, the index closed within 1.6% of its previous milestone set back in August of 2021. Gains were reasonably broad-based although we still saw over 30% of the index close in the red, the resources again weighed on the index while the growth related stocks were the standout winners e.g. Xero (XRO) +5.3%, Megaport (MP1) +7% and carsales.com (CAR) +3.5% – we are seeing a new trend emerge, if bond yields simply trade sideways then tech stocks extend their recovery. However the current “bounce” can be put into perspective when we consider how some of the individual sectors have performed in 2022 while the underlying ASX200 index is up 1%:

Winners : Banks +8.1%, Materials (Resources) +10.3% and Utilities +13.8% – I’m sure the last one wouldn’t have been at the front of many subscribers minds.

Losers : Tech -11.1%, Healthcare -10.1% and Retail -9.7%.

We’ve said it numerous times over recent months but the crux of the current market is sector rotation while the index has a core upside bias, we see no major change with the constant evolution under the hood but we do believe the index is slowly becoming vulnerable to a downside bias, especially if / when we see fresh all-time highs.

After digesting Josh Frydenberg “election budget” Goldman Sachs are now forecasting 4 interest hikes by the RBA in 2022, they better get a wriggle on as time is passing fast! The Banking Sector is loving these hawkish forecasts and we saw National Australia Bank (NAB) hit 5-year highs yesterday and similarly Commonwealth Bank (CBA) would probably have made fresh all-time highs if it hadn’t traded ex-dividend $1.75 fully franked in mid-February – we believe it’s too early to sell / reduce Australian banks but they are approaching the station.

Overnight we saw US stocks slip lower after hopes for de-escalation in the Russia-Ukraine conflict faded which also led a more than 3.6% bounce in oil prices. The tech heavy S&P500 closed down -0.6% whereas the resources rich local market is poised to open slightly higher helped by a $1.40 pop in BHP Group (BHP) during US trade.