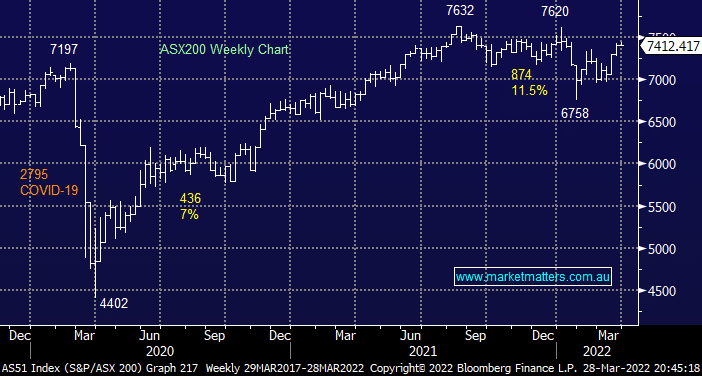

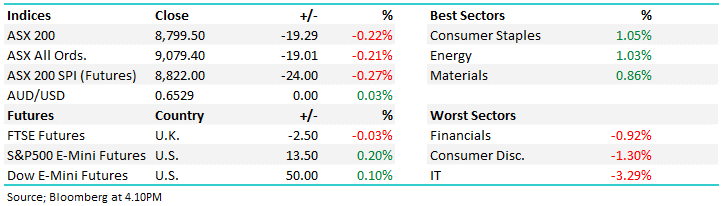

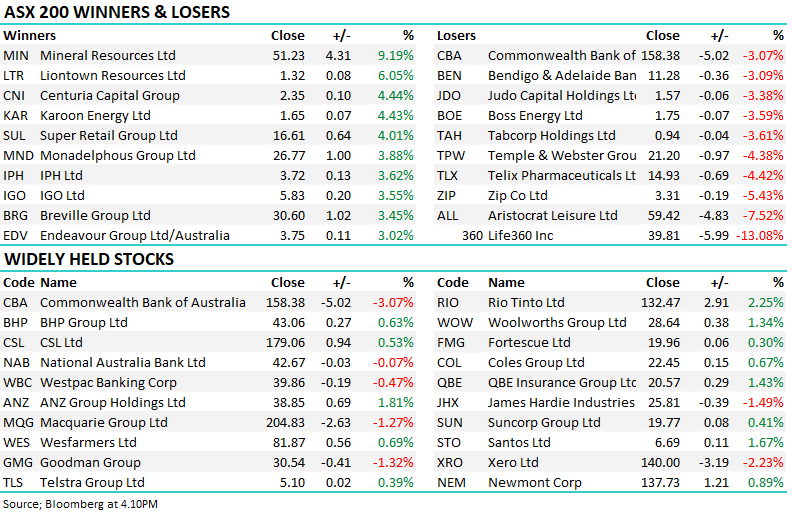

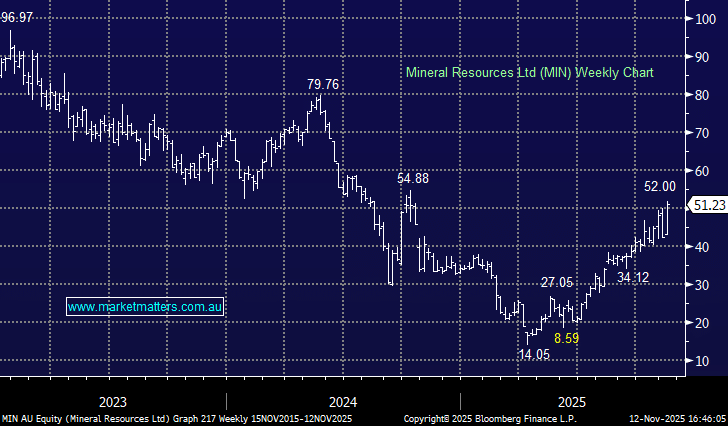

The ASX200 managed to hold on to small gains come 4pm on Monday after grinding lower from our midday highs approaching 7450, the index’s highest level since mid-January. The markets feeling a touch tired having already rallied +5.6% in March but although only 40% of the main index closed up yesterday when the banks and big miners are strong the ASX tends to follow suit e.g. Westpac (WBC) +1.2%, RIO Tinto Ltd (RIO) +1.4% and BHP Group (BHP) +2.3%. Its been this exact impressive performance from these 2 influential sectors that’s enabled the ASX200 to be a standout relative performer falling under 0.5% year to date:

- In Q1 we’ve seen Westpac (WBC) +11.2%, National Australia Bank (NAB) +9.8%, Woodside (WPL) +53.2%, RIO Tinto (RIO) +17.6% and BHP Group (BHP) +19.9%.

- These heavyweights have helped the ASX200 limit its 2022 losses to -0.4% whereas the Dow has fallen -4.1%, the NASDAQ -9.6%, and Europe’s EUROSTOXX 50 -8.7%.

Beyond the stellar performance from the local market, the statistic catching our eye above is that rising bond yields are hurting the tech/growth stocks more than Russia’s invasion of Ukraine is weighing on European indices – potentially the market believes inflation is here to stay whereas Putin will commence serious negotiations in the coming weeks. We are still in Q1 and there has been some significant volatility and rotation on the stock, sector, and index level, MM believes there’s a lot more to come making it an exciting time for Active Investors like ourselves.

We certainly cannot ignore bond yields in 2022 as they’ve been the main driving force across markets, yesterday we saw the Australian 10-year bond surge to 2.92%, very close to double where we started the year – the faster bond yields accelerate higher the more banks & resources are likely to outperform and by definition so will the ASX.

Overnight we saw US stocks put in a mixed performance as bond yields took a breather on the upside which led to a +1.2% rally by tech stocks while a 9% pullback in crude oil on Chinese lockdown concerns led to a reversal of the recent strength by Energy & Materials stocks. The SPI Futures are maintaining their glass half full approach to 2022 rallying around 0.4% as growth stocks finally look poised for a strong day at the office.