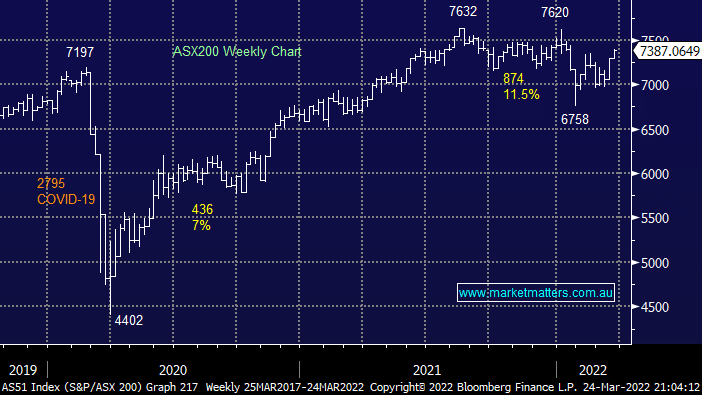

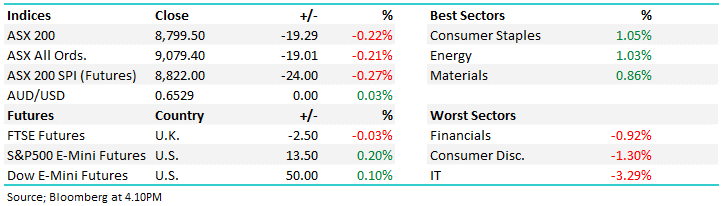

The ASX200 demonstrated its resilience yesterday after managing to eke out a small gain even after the Dow fell over 400-points, we believe the local market will continue to outperform the US over the coming weeks / months. The market peaked at 7399 into the close helped a recovery by the US futures during our day session but by midday the ASX had already confirmed the notable absence of any selling into weakness. The markets now rallied +6.2% from its March low to test 10-week highs, we remain bullish with fresh all-time highs feeling increasingly likely as different sectors of the market take it in turns to drag the index higher.

Rising bond yields have exerted an increasing influence on financial markets over the last 6-months, even while COVID failed to go away and Russia invaded the Ukraine, we felt this Friday would be a good time to compare todays macro position to the last few decades as we rally into the classic “sell in May & go away” period for stocks:

- Between February 1994 and February 1995, the Federal Reserve hiked interest rates from 3.25% to 6%. Initially in 25bp increments but then by 50bp and 75bp in response to a strong economy and a subsequent inflation rate of ~2.5%.

- Today we have inflation surging to 7.9% and rates have only risen from 0.25% to 0.5%, implying there’s clearly a lot further to go.

- This week St Louis Fed President Bullard reiterated he would like to see the FOMC hike rates aggressively to 3% by Christmas as he likened the current cycle to the abovementioned 1994-95 period.

Stock markets like a strong economy hence rising yields / rates is ok if it’s not too fast, in late 2018 we saw the US S&P500 plunge 20% as the market experienced a “Taper Tantrum” when yields popped too fast before they recovered strongly. Way back in 1994 stocks dipped 10% before meandering sideways, the US S&P500 has already corrected 15% over recent months suggesting that rising bond yields could even be old news i.e. already built into prices. Its going to be a fascinating year which we believe could easily see the ASX200 test 7800 and 6600 with the most important aspect for investors being prepared to stay open-minded.

Fund managers have seen the market rally strongly over the last week hence they’re reticent to chase things higher around 7400 but the lack of selling is illustrated by the volume for the SPI futures being over 30% below its average i.e. we believe it’s just a matter of time until someone throws in the towel and starts driving stocks up towards 7600. The bearish sentiment in the US with only 22% of respondents bullish, the same being overwhelmingly true with clients that I speak with in Australia – markets rarely decline with the bears so dominant.

Overnight we saw US stocks recover strongly with tech the best on ground while energy names were the only group to fall, equities were happy to follow yields higher as was gold, again suggesting Fed hikes are largely built into prices. The Dow finished up 350-points which is helping the SPI futures point to an early 38-point gain by the ASX200, back above the psychological 7400 level.