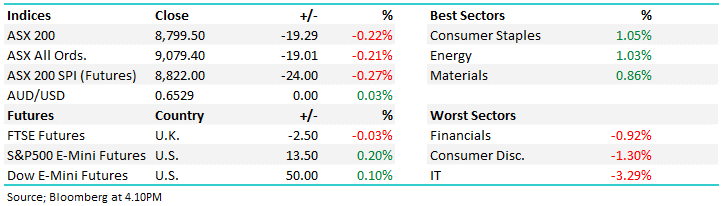

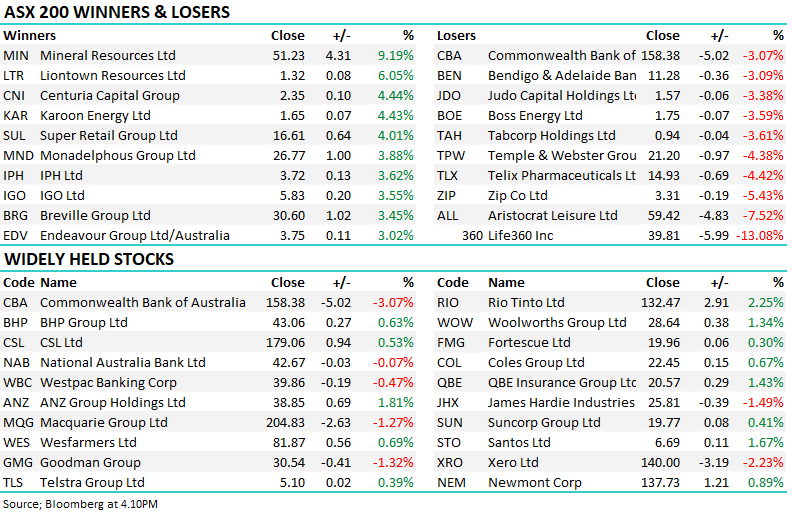

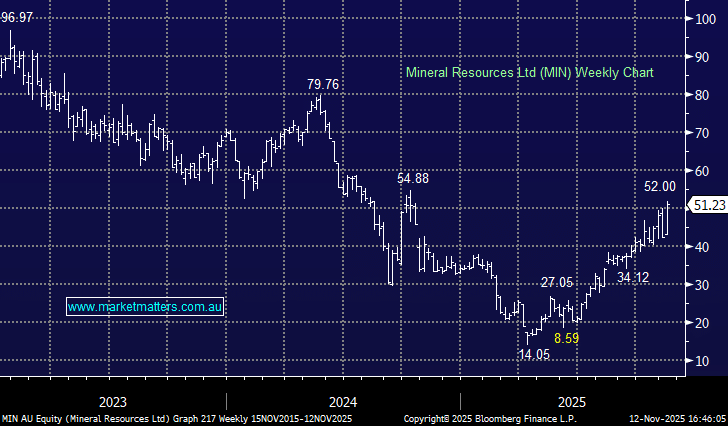

The ASX200 enjoyed a strong “Hump Day” to close up exactly 0.5% higher registering its highest close since mid-January – it’s now only 3.5% until local stocks challenge their fresh all-time highs. Again we saw the banks perform the heavy lifting with CBA rallying to within 2.6% of its December high, even after trading ex-dividend $2.00 fully franked in February, investors will receive this tasty morsel in the 1st week of May. The IT stocks were the standout over the session rallying 3.5% while the major miners slipped slightly lower, MM believes tech stocks will maintain this outperformance over at least the coming weeks – remember it’s only a bounce for growth stocks after an awful 6-months.

MM has been calling the banks higher through Q1 and into Q2, as mentioned earlier CBA illustrates this call is looking good, we should have bought ANZ when we discussed it earlier in the month but hindsight is a great investor. Interestingly yesterday saw Morgan Stanley forecast ANZ and NAB will increase their combined buybacks by $3bn when they report in May, ongoing bullish rhetoric such as this is likely to push the sector towards levels where MM will reduce our exposure. Investors are buying the sector as yields rise although MM is wary of a flattening yield curve that will weigh on margins.

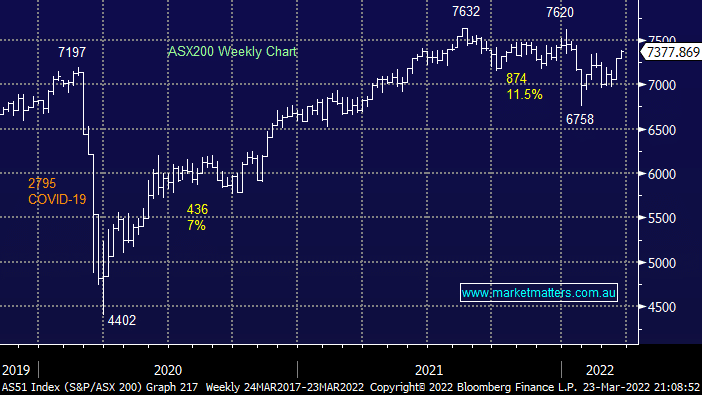

Australian bond yields continued their upward march yesterday with the 3-years nudging 2.25%, to put the dramatic change in macro backdrop into perspective they were trading below 0.2% only 6-months ago! Previously we had been looking for a period of consolidation back towards 1% before we saw another inflation triggered surge higher but in hindsight, MM was being too pedantic trying to pick the twists and turns in what we believe is an end to the multi-decade bull market for bonds/bear market for yields – our best guess is they will now consolidate between 2 and 2.5% but ultimately pullbacks in yield should be bought a factor which MM believes will ultimately weigh on equities through 2022 / 23 i.e. the recent underperformance by the growth sector has just been a warning.

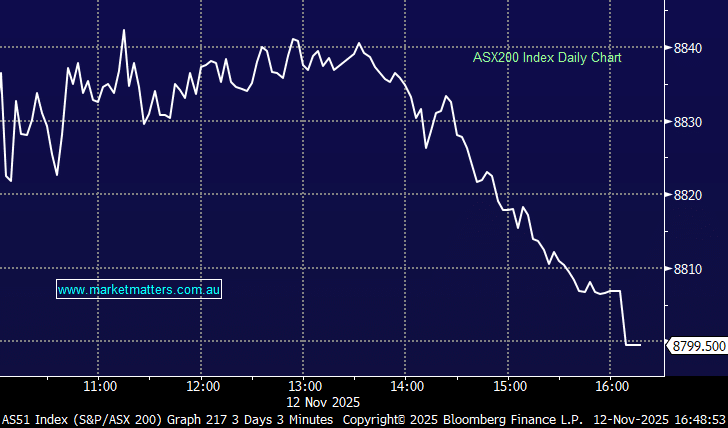

Overnight we saw US stocks falter as bond yields also took a rest on the upside, on the S&P500 the financials and healthcare sectors struggled which looks set to weigh on the ASX today as the SPI futures call the ASX200 to open down around 0.7% which would see the local bourse surrender all of yesterday’s gains on the open.