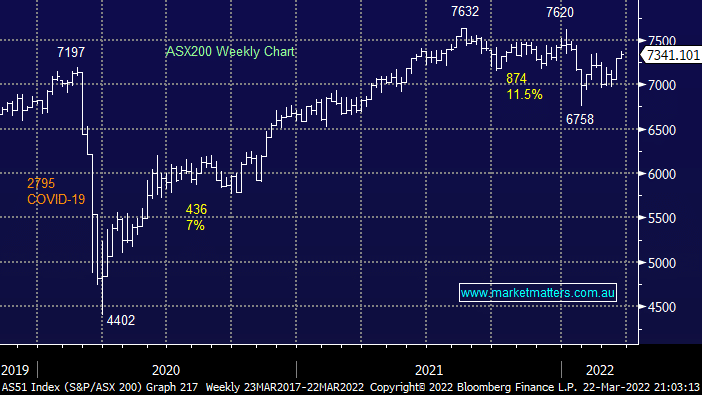

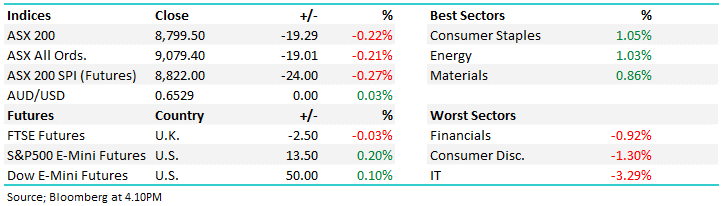

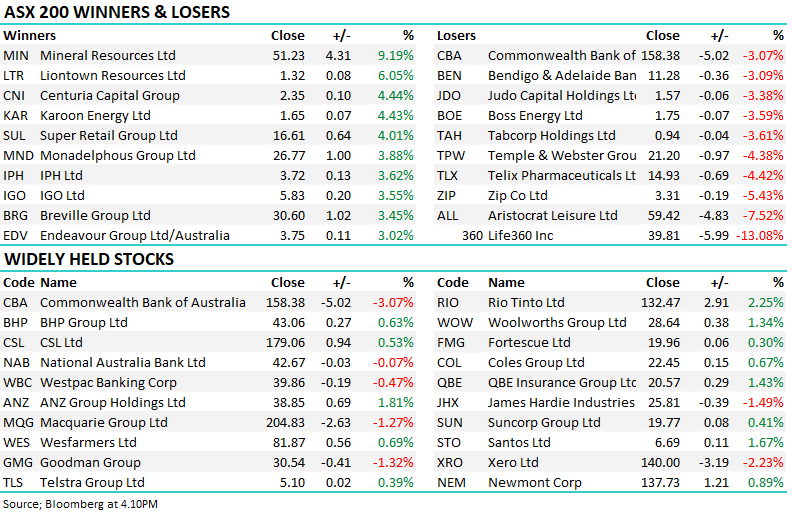

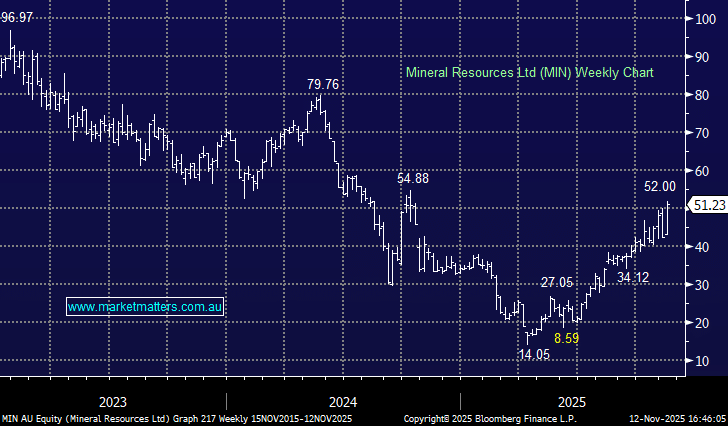

The ASX200 rallied another +0.86% on Tuesday helping it scale fresh 9-week highs, it might surprise many readers to know it’s now less than 4% below its 2021 all-time high – the markets literally had the kitchen sink thrown at it for the last 7-months but only the staunchest bears could argue it hasn’t performed admirably. We only saw 54% of stocks rally yesterday but when the banks remain firm and resources soar the ASX is going higher e.g. BHP Group (BHP) rallied +5.1%, perhaps some of the $10bn landing in shareholders accounts next Monday has already started filtering itself back into the miner.

I’m sure everybody’s heard of the phrase “cash is king”, well just consider that investors are receiving $3.8bn in dividend payments this week and an eye watering $24bn next week – a significant percentage of this will find itself into an already short / underweight market. The seasonal playbook is working so far this year and its this very flow of dividends that historically helps the ASX through until mid-April, so far in 2022 the local market is actually on track to deliver its greatest outperformance over US stocks in 7-years as rising inflation / bond yields see the Resources Sector soar while US Big Tech’s dived.

The hawkish comments from Fed Chair Jerome Powell this week has dramatically raised the possibility of a shock style 0.5% rate hike (s) this year as they’re clearly becoming extremely concerned about surging inflation. The ongoing rally in bond yields has taken the local 3-year bonds above 2% for the 1st time since 2018, at least for now breaching a level we thought would hold the current advance – fixed rate home loans haven’t been raised yet but it can’t be long!

Overnight US stocks continued their recovery even as bond yields continued to rise, the broad US market has now recovered about half of its losses since the start of the year. The macro news might not be all good for stocks but uncertainty is slowly dissipating from investors minds which appears to be the calming influence which was needed for stocks to advance, even with BHP falling -2.7% in the US the SPI futures are pointing to the ASX200 opening around 30-points higher, back towards yesterday’s highs.