The ASX200 rallied strongly yesterday to close up +1.1% enjoying further broad-based buying which saw 75% of the index close in positive territory for the day as we closed above the last 3-weeks high. Similar to US indices the ASX enjoyed some strong buying in the IT stocks following the Feds rate hike and hawkish comments which illustrated how crowded the anti-growth stance had become at the start of the week, remember the statistics we recently quoted from the Bank of America Fund Managers Survey:

- Fund managers have increased their cash holdings to a 2-year high & allocations to global equities are at their lowest level since May 2020.

- Cash allocation to commodities had soared to record levels while exposure to tech had fallen to its lowest level in 16-years.

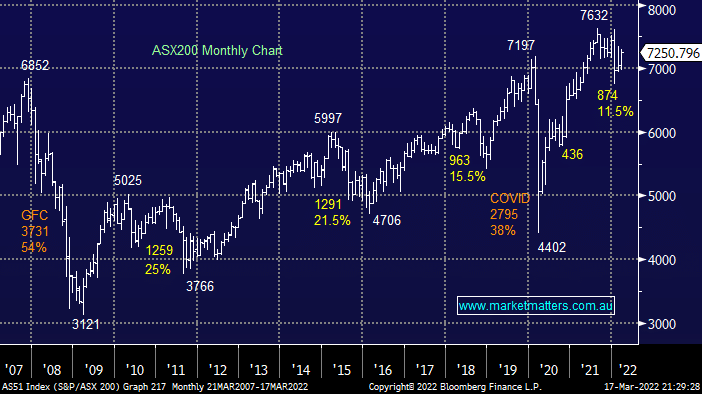

In simple terms, even with rate hikes unfolding as expected, whose left to sell stocks and especially the embattled tech sector i.e. MM believes growth stocks can bounce sharply in the coming weeks with the resources sector a potential funding vehicle. We know from speaking to subscribers on a day to day basis that many local investors are absorbing the bearish rhetoric being peddled by the press but the ASX200 is still only 5% below its all-time high and well above its pre-COVID 2020 top i.e. a stellar performance in our opinion considering what’s been thrown at equities over the last 2-years, and with $24bn of dividends hitting investors bank accounts before April we could easily be trading higher than many ever hoped as risk assets unravelled in late January.

- History tells us that markets often rally once the rate hikes begin but this is a multi-decade change in trend, MM expects to fade any decent strength over the coming weeks/months but an initial rally towards 7600, or higher, wouldn’t surprise us!

- From a simple range perspective if March sees the ASX200 simply match February we should be testing 7400 over the coming weeks.

Overnight we saw US stocks extend their post-Fed rally while the $US dollar retreated which helped commodities including oil & gold bounce solidly, the SPI futures are pointing to a 35-point rally this morning back towards the 7300 area.