- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX finished lower today with decent sessions from miners and energy stocks more than offset by weakness in technology and financials, as selling in CBA struck again, capping broader momentum.

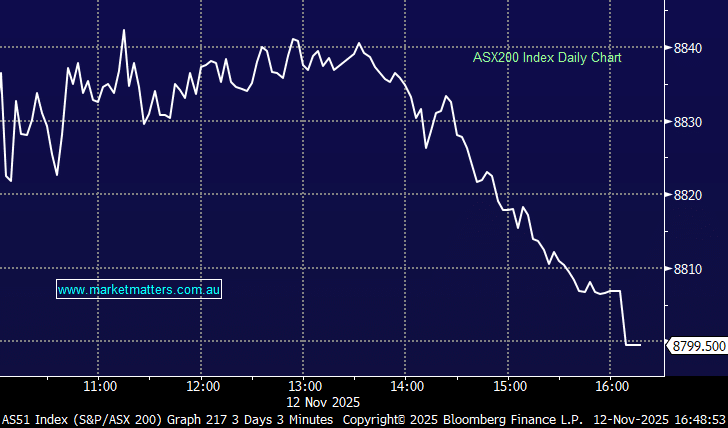

- The ASX200 fell -19pts/-0.22% to close at 8799.

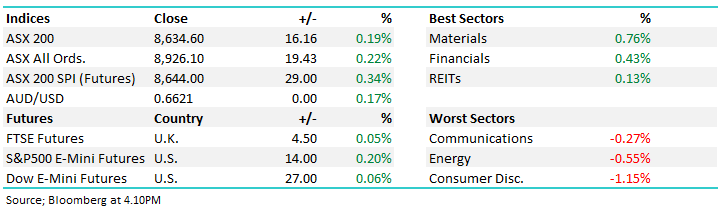

- Staples (+1.05%), Energy (+1.03%) & Materials (+0.86%) led the line.

- IT (-3.29%), Consumer Discretionary (-1.3%) and Financials (-0.92%) the weakest links.

- Commonwealth Bank (CBA) -3.1% slipped again on valuation and margin compression, as rotation continued into peer ANZ +1.8%.

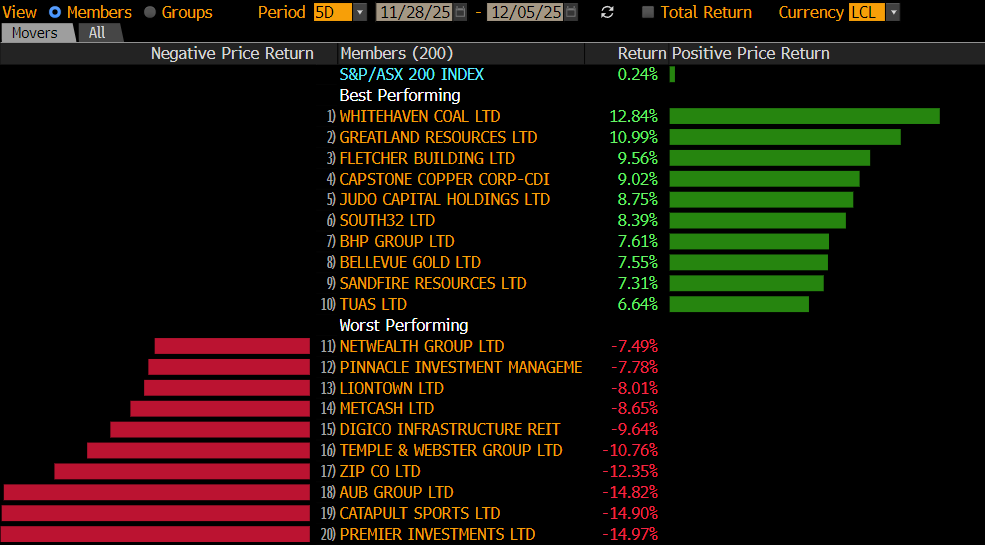

- Mineral Resources (MIN) +9.1% surged after announcing a US$765m (A$1.2b) sale to South Korea’s POSCO, forming a new JV over its lithium assets at Wodgina and Mt Marion, allaying balance sheet concerns.

- Life360 (360) -13.1% down again as investors continued to weigh yesterday’s trading update showing slower user growth quarter-on-quarter, despite ongoing revenue momentum.

- Liontown Resources (LTR) +6% advanced to a one-year high after partnering with Metalshub to auction spodumene concentrate digitally.

- Aristocrat Leisure (ALL) -7.5% fell after a 9% profit rise was overshadowed by a miss in its interactive gaming division, as well as some flow to Light and Wonder (LNW) +1% after a number of positive announcements over the past week.

- Flight Centre (FLT) +1% was up as much as 7% in early trade, but softened into the close after reaffirming FY26 profit guidance of $305–$340m, supported by robust corporate travel bookings. Consensus was already at $317m, so it wasn’t a significant bump.

- BHP +0.6%, Rio Tinto (RIO) +2.2%, and Fortescue (FMG) +0.3% gained on firmer iron ore prices and optimism around China stimulus.

- Woodside (WDS) +1.4% and Santos (STO) +1.7% strengthened alongside higher crude prices, extending recent energy-sector gains.

- Asian markets were mixed, with Hong Kong up +0.60%, while China -0.14% and Japan –0.25% fell.

- Gold traded down US$22 during the session to $4104/oz around the close.

- Iron Ore in Singapore traded up 1%, now trading $102.60/mt at our close.

- US futures are all up.