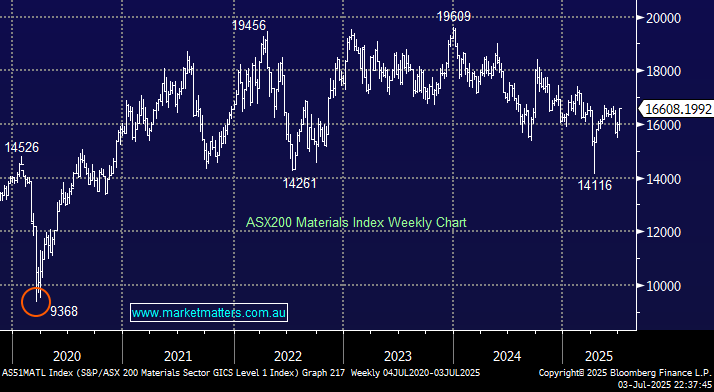

Global indices have been posting new highs over recent weeks but the materials indices remain almost 20% below their early 2024 highs. Concerns around the Chinese economy, emanating from their real estate crash, have weighed on the commodities space. Still, as their targeted stimulus slowly takes effect, we believe the worm is turning. While the impact of tariffs from the US towards China is a real threat, recent noises between the two parties have been relatively conciliatory:

- Chinese goods, which were temporarily subject to tariffs as high as 145%, are currently subject to 30% across-the-board tariffs.

The trade war comes with consequences for both sides, with China avoiding purchasing US crude for the third straight month, the longest stretch since 2018, delivering a fresh blow to shale drillers already facing lower oil prices. According to US Census data released Thursday, the world’s biggest oil importer bought no American crude in May, following zero purchases in both March and April as a trade dispute between the largest global economies unsettled markets. The absence of Chinese buying sent US overseas oil sales tumbling to the lowest in two years. With both parties at risk in the trade war, we can see ongoing compromise between the two economic superpowers.

- We are initially targeting the 18,000 area for the local materials index as fund managers rebalance portfolios.

This morning, we’ve examined four ASX-traded ETFs that provide exposure to the resources space. This is one area we don’t need to venture overseas, with the ASX containing some of the best miners and related ETFs available to investors.