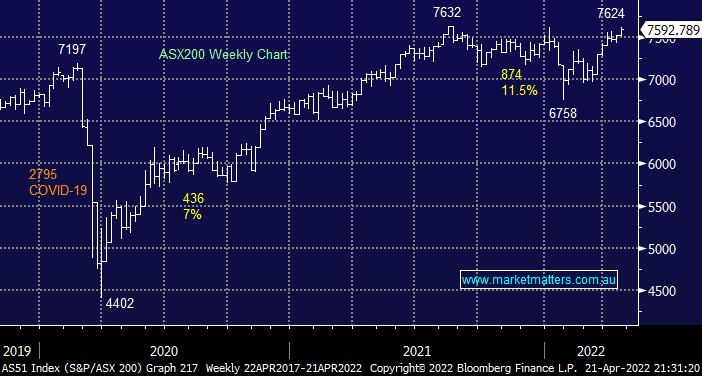

The local market continues to knock on the door of new all-time highs which I’m sure amazes many subscribers and even for bulls like MM its impressive when we consider the huge macro headwinds that have been thrown at equities through the early months of 2022:

- Bond yields have exploded on the upside in anticipation of aggressive interest rate hikes from global central banks e.g. Australian 3-year yields have already soared from 0.9% to 2.6% and its not even May!

- Global inflation is rising at its fastest rate in 40-years under pressure from ongoing COVID supply chain constraints, pent up consumer demand post the pandemic, Russia’s invasion of the Ukraine and massive global economic stimulus over the last 2-years to name just a few factors.

- The prospect of a recession over the coming years is becoming increasingly a fear as rates look set to rise aggressively and Russia throttles the world’s economic expansion with higher oil prices etc.

- Risk assets continue to face the uncertainty of Putin and of course Chinas next move as they both try and increase their global footprint while another severe strain of COVID is being discounted in a manner to shock any decent statistician.

There’s undoubtedly a huge undercurrent of financial anxiety in play today which is understandable and it led to the sharp 11.5% drop by the ASX in January as the first rumblings of quantitative tightening (QT) rolled through markets e.g. the RBA is now forecast to hike official interest rates to around 1.5% over the next 12-months but we shouldn’t really panic as they were at 4.75% in 2011, well after the GFC. Investors are getting very nervous / scarred as they see housing prices slip and prices of everything rise, we hear it all the time at MM that investors are thinking of “cashing in their chips” but indices aren’t falling even as confidence in stocks plummets to multi decade lows although unfortunately we know the herd has an excellent track record of being wrong when they all move together.

- Remember the US markets Bullish Consensus is at a 32-year low which to MM implies a strong possibility of an aggressive short squeeze i.e. if MM were traders we would be long, or simply square.

MM has been bullish through 2022 targeting a pop to the 7700-7800 area but at this stage we see surprises far more likely on the upside as opposed to downside with that unthinkable psychological number 8000 now only 5.3% away and as we saw with his weeks bid by KKR’s for Ramsay Healthcare (RHC), professional investment houses still see plenty of value in certain pockets of the ASX.

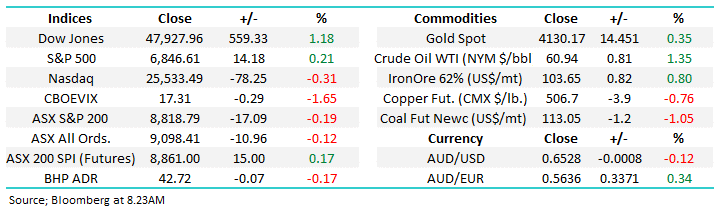

Overnight we saw US stocks suffer a sharp reversal as bond yields maintained their upside momentum, US 10-years are continuing to knock on the 3% door, basically double where they commenced 2022. The S&P500 was up 1% early on before reversing to close down -1.5% led by falls in the Energy Sector, the SPI futures are calling the ASX200 down 0.9%, back below 7550 with a $2.25 / 4.4% fall by BHP likely to weigh heavily on the local index.