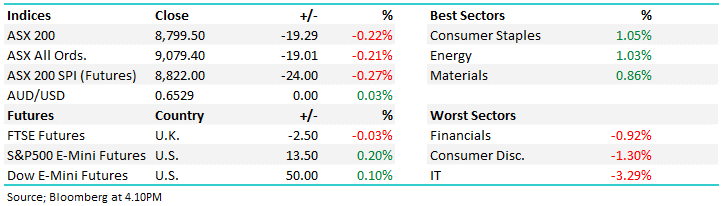

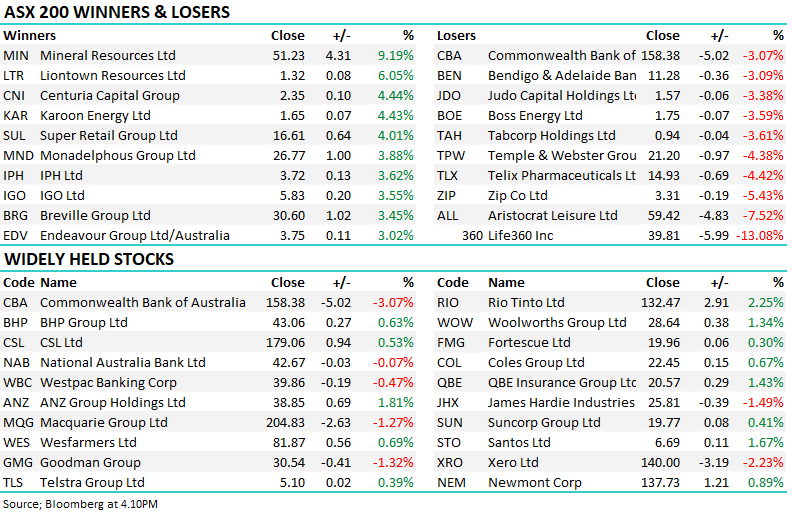

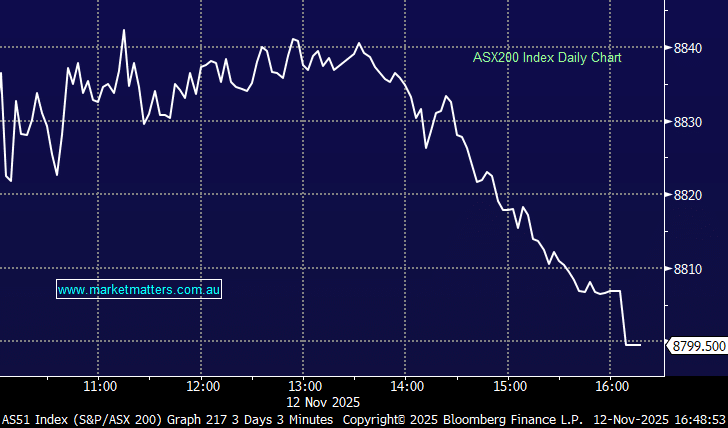

The ASX200 surrendered early solid gains yesterday as it took direction from the US futures slow meander lower, we finally ended the day down just 0.2%. Overall when compared to the last few weeks it felt like a pretty quiet session with a +2.5% gain by the Tech Sector the main standout on the day while the banks experienced a rare day in the red, less than 3% of the main index moving by over 5% told the tale of the day. Basically after surging +5.5% over just 9 sessions the market needed a well-earned rest and it took one!

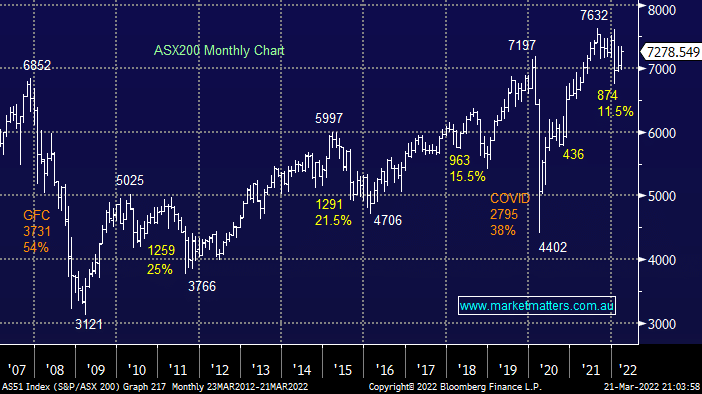

MM’s preferred scenario is we test of 7400 this month and 7600 in April but considering its less than 4.5% to our 2nd target, following the last few weeks strong gains, it wouldn’t surprise us to see a few relatively quiet weeks i.e. it’s not every day that markets can produce the explosive moves witnessed by the likes of nickel, coal and wheat in March. On a sector level we still feel Tech will maintain its outperformance of the last few days after its aggressive decline as bond yields surged over the last 6- months – just a rest on the inflation rhetoric should be the required catalyst.

We saw an excellent example yesterday of how the market changes its focus on a regular basis and rarely looks back after moving onto the “the next big thing” i.e. around lunchtime on Monday we saw embattled Chinese property developer China Evergrande and all of its related entities placed in a trading halt without reason but stocks didn’t crash as they would have a year ago. I guess with the stock having already tumbled from over $30 to less than $2 the news couldn’t get much worse for 3333HK but there were no associated headlines such as it was the beginning of the end for construction in China and by definition the likes of iron ore, Fortescue (FMG) even closed up on the day – it’s simply old news and just like COVID it’s no longer the markets focus moving forward.

Overnight we saw US stocks retreat following extremely hawkish rhetoric from Jerome Powell, he said the Fed is prepared to move “quickly & aggressively” if needed on interest rates. Bond yields surged to new 2022 highs on the news and the tech based NASDAQ slipped lower but nothing too dramatic considering the backdrop, the SPI futures are actually calling the ASX200 up over 1% this morning helped by a $2 rally by BHP Group (BHP) in the US as oil bounced over 7%.